3 Reasons NFLX Can’t Lose

Netflix is having a rough week.

The company reported 21Q4 earnings that beat Street expectations on the top and bottom line.

The streamer added 8.28 million global subscribers, higher than the 8.19 million expected and nearly double the net additions recorded in the prior quarter.

But shares plummeted by nearly -20% after hours.

What happened?

Netflix issued weaker-than-expected guidance moving forward, calling for 2.5 million new subscribers next quarter versus the nearly 4 million it added in the same quarter a year ago — quite a slowdown.

The reasoning? Netflix’s content schedule is weighted toward the back end of the quarter, with big releases (like the second season of “Bridgerton,” for anyone curious) slated for March.

But the market’s knee-jerk reaction may prove to be shortsighted.

And at LikeFolio, these are exactly the kinds of setups we’re watching for.

Here’s why we think this move in Netflix may be a huge opportunity for long-term investors…

Netflix Has Pricing Power

When Netflix announced its latest price increase, our hedge fund clients wanted to know: Will this cause people to cancel their subscriptions?

The answer: an overwhelming “No!”

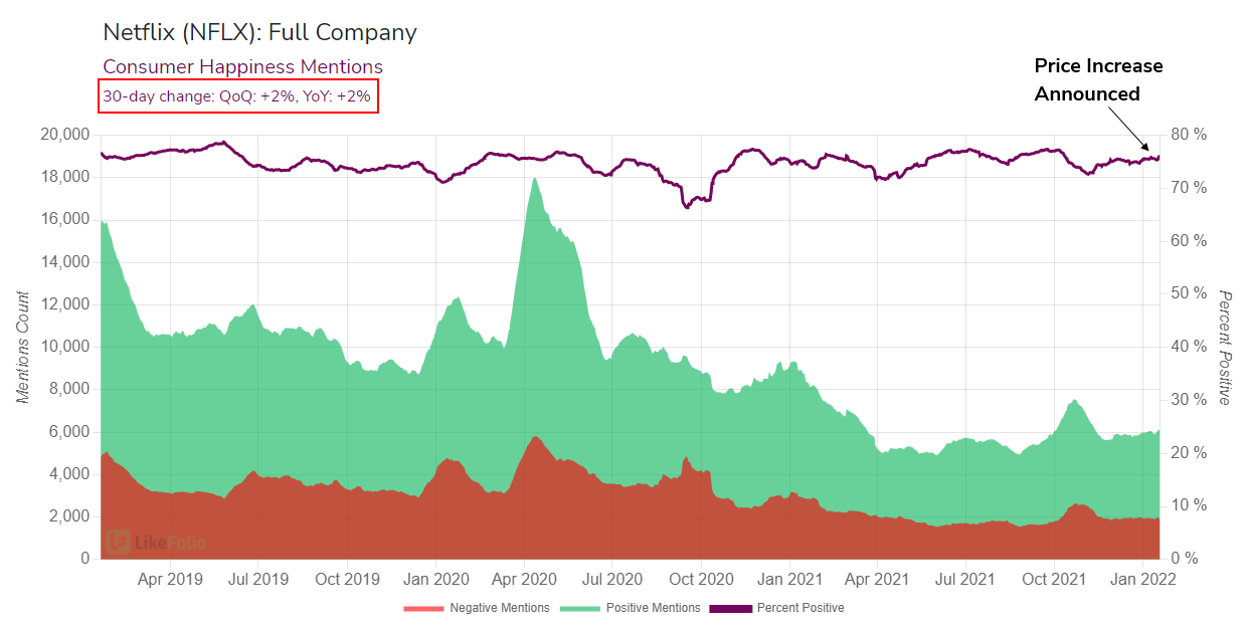

Here’s the proof, straight from LikeFolio’s real-time consumer happiness monitoring engine:

If you look closely at the right side of the chart, you’ll see that the purple line (consumer happiness level) actually INCREASED after Netflix announced the price hikes.

That usually doesn’t happen, folks. Netflix has something special.

But what is that magic formula?

Thrill subscribers with original content they can’t get anywhere else.

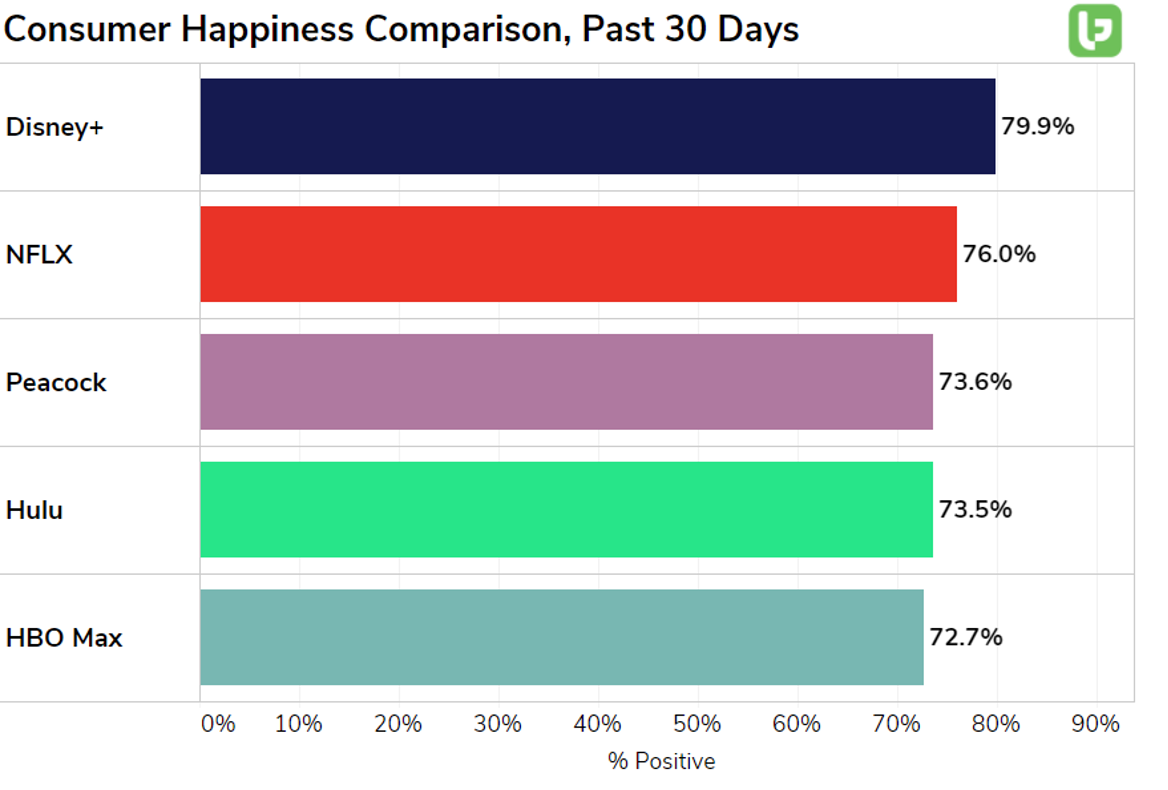

And Netflix has become one of the best in the world at that, coming in second place among all streaming services to the King of Content, Walt Disney.

Having happy subscribers means having millions of people who are far less likely to cancel their service when the charge on their credit card increases.

And all of those $1-$2 extra charges add up in a big way, increasing profit margins and cash flow immediately.

Bottom line?

We believe Netflix customers are happy enough to accept at least two to three more subscription price hikes over the next 18 months without a significant impact on churn.

Netflix Is Expanding Its Dominance

It seems like every time you turn around, there is a new streaming service seeking a slice of the growing population of cable deserters.

Normally, we would expect this influx of competition to decrease overall market share for the category leader.

But not Netflix:

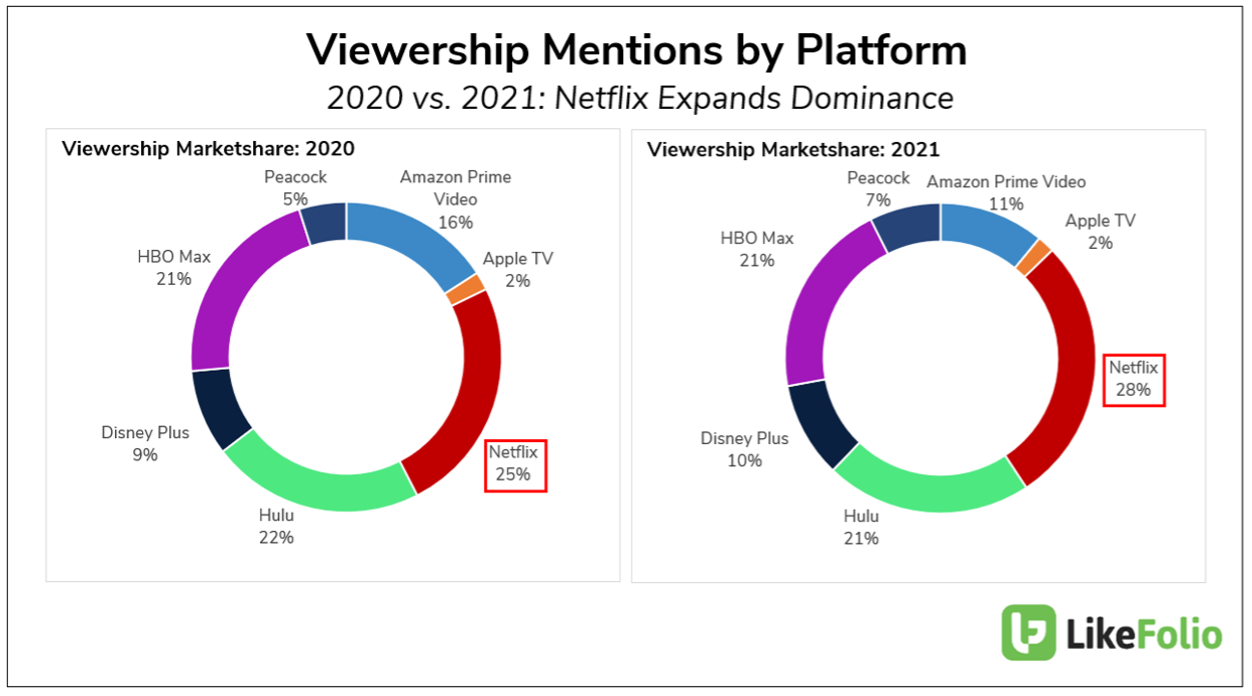

LikeFolio’s powerful tracking of consumer viewership mentions gives us real-time insights into how many people are talking about watching shows or events on each of the various streaming platforms.

We think of this as an indication of engagement — how much are subscribers actually using the product they’re paying for?

In the chart above, you can actually see Netflix’s share of viewership mentions increase from 25% in 2020 to 28% in 2021.

That’s a big move in a fairly saturated industry full of well-funded and aggressive competitors.

Strong engagement numbers tell us that Netflix subscribers are receiving high value for their monthly payment — another indication that they’ll be unlikely to cancel the service over a few dollars each month.

Netflix Subscribers Are Loyal

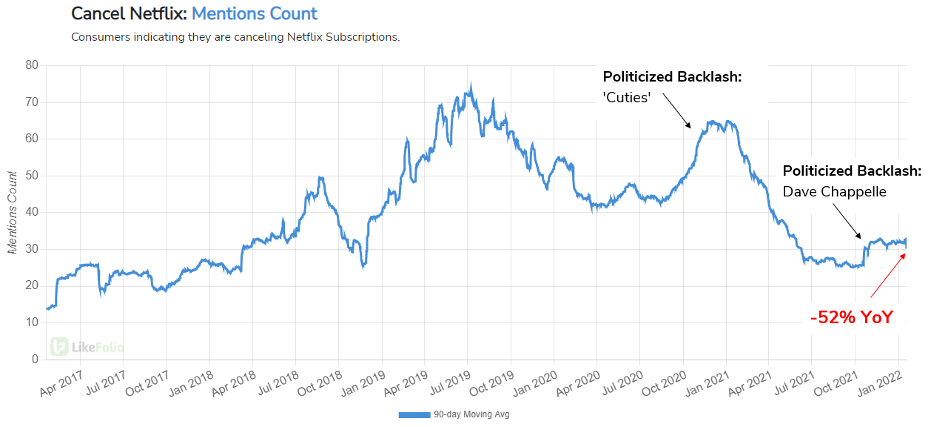

Despite a growing number of overall subscribers, and near-constant programming controversy, Netflix cancellation mentions are 52% lower today than they were a year ago.

In fact, the most common reasons we see for people claiming they are going to cancel their subscription to Netflix are political in nature, and therefore more likely to be public statements of ideology than actual indications of lost subscribers.

While Netflix customers may have serious objections to some of its original programming choices, the overall menu of content is so high quality that it is more likely a subscriber will simply move on and find a series they do enjoy.

And then binge-watch it until 4 a.m. without even realizing it.

Or is that just me?

Summary: It’s Netflix’s Game to Lose

Even after all of the massive growth, and the amazing run in Netflix stock (which our clients have been happy participants in), we continue to see incredible opportunity in Netflix.

They’ve got extremely happy, loyal customers who will absorb reasonable (but frequent!) price hikes over and over again… as long as the company can continue creating original content hits.

And that money will be dropping straight to the bottom line, giving Netflix a unique strength: The ability to turn on increased revenue and profits with the “flip of a switch,” without turning its customers off.

Megan Brantley

Head of Research, LikeFolio