Are Consumers Scared to Travel?

As pandemic-related fears set in, it’s important for investors not to panic.

Instead, listen to the consumer.

The delta variant has dominated media headlines in the last month, with many of us wondering how this will impact consumer travel behavior.

But according to LikeFolio data, this may be slightly overstated… for now.

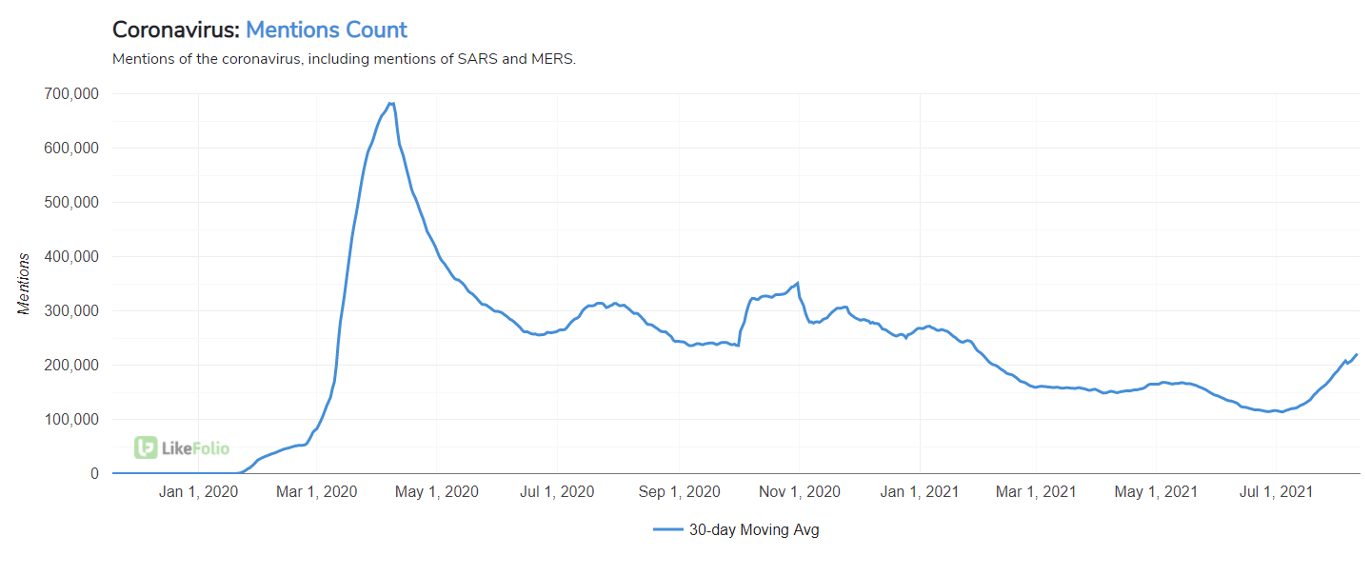

Consumer mentions of the coronavirus have been increasing since July, but these mentions remain well below 2020 averages.

But more importantly for investors: Are consumers scared to travel?

According to LikeFolio booking mentions and TSA throughput data, not yet.

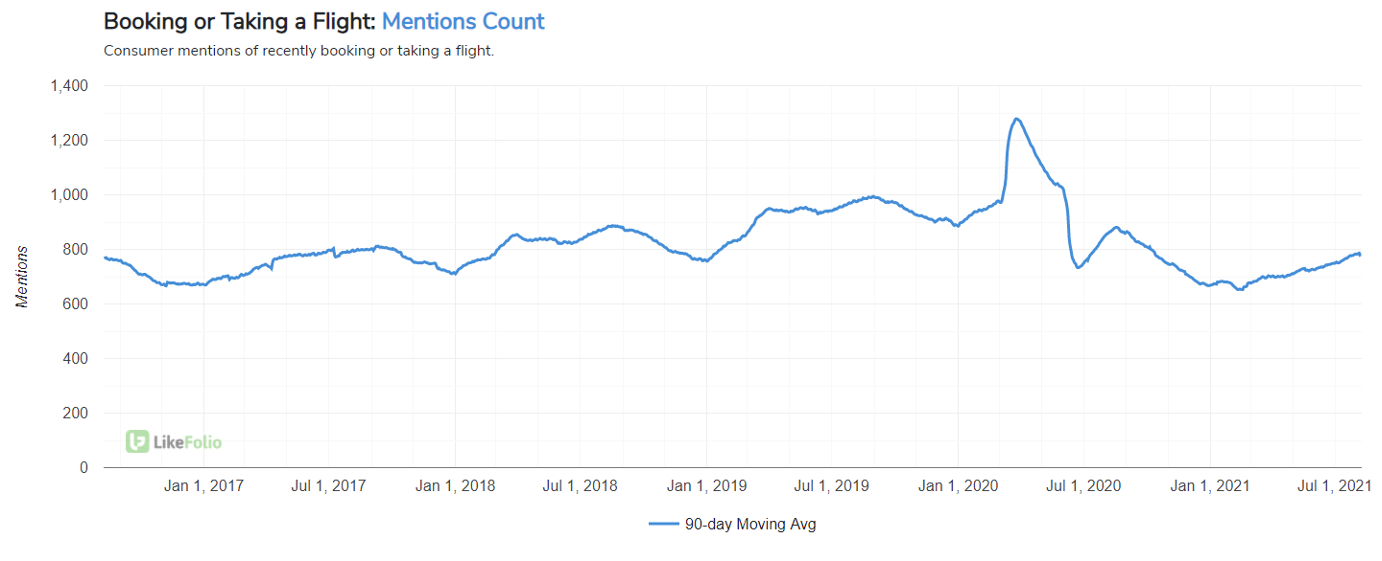

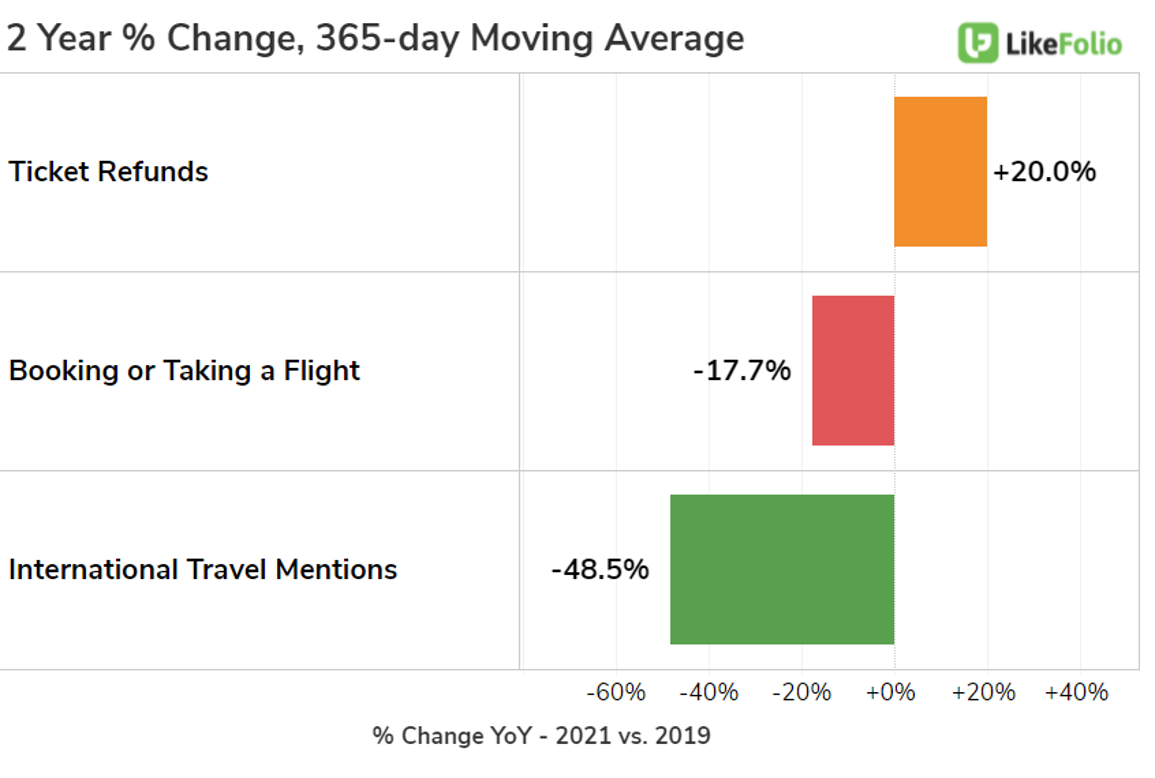

Mentions of consumers booking or taking a flight are still improving… but these do remain below pre-pandemic levels, with international travel stunted more severely versus domestic.

While cancellation mentions look relatively stable versus 2019, mentions of consumers experiencing flight delays have increased +400% YoY, and consumers aren’t happy.

It’s no surprise to see the number of consumers seeking ticket refunds elevated versus 2019: +20%.

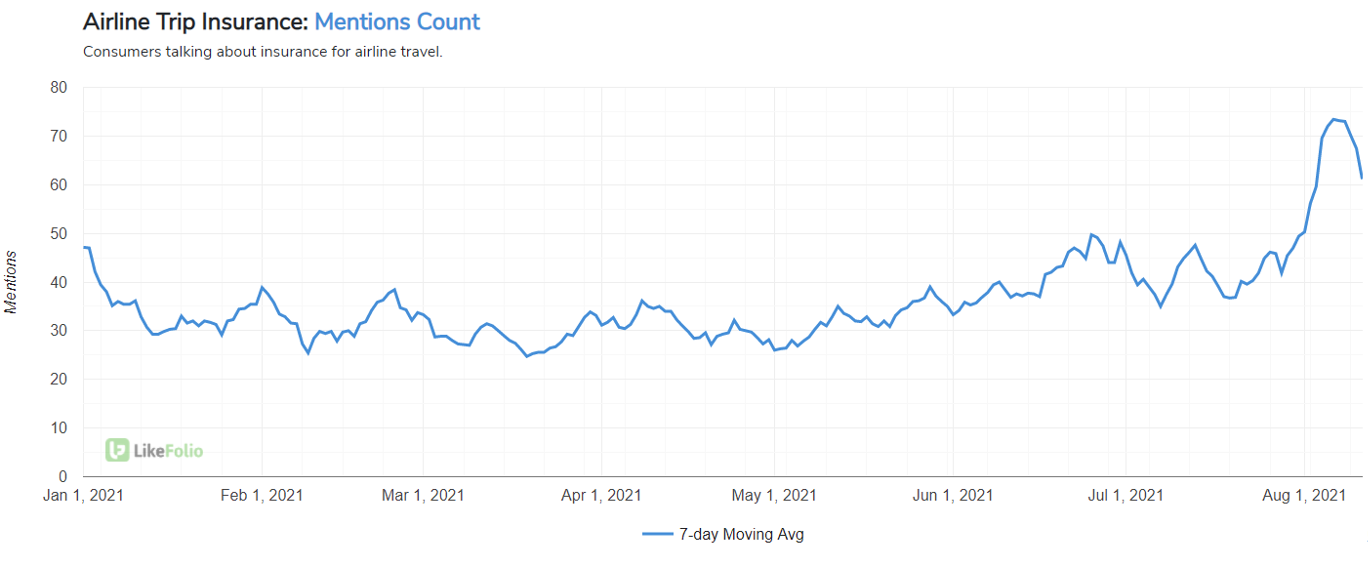

But this isn’t the consumers’ first rodeo. Many are proactively protecting against delays and cancellations amid uncertainty.

What do we mean? Travel insurance.

These mentions have increased +82% QoQ on a 7-day moving average.

And now, we can take this knowledge a step further.

If consumers want travel flexibility, they are likely motivated to purchase airline tickets from carriers with flexible policies.

This is where you can see some best-of-breed leaders rising to the top…

Airline Comparison: Leaders and Loser

When we break down the major airline players (LUV, DAL, UAL, AAL), data reveals four main takeaways.

- Southwest Airlines (LUV) is somewhat insulated thanks to resiliency in leisure travel demand. LUV Purchase Intent mentions have increased +64% YoY, leading the pack. Flying for leisure mentions continue to gain steam: +39% QoQ.

- Delta Air Lines’ (DAL) demand is being bolstered by signs of business travel resumption. Traveling for work mentions have increased +39% YoY, but do remain below pre-pandemic levels. Delta Consumer Happiness is the strongest of the group at 52% positive.

- While United Airlines Holdings’ (UAL) Happiness is in line with peers DAL and LUV, it trails both companies in regard to a return to pre-pandemic booking mentions (by more than 10 points). This suggests the company may not be benefitting as much in the near term as better-positioned peers, even though it continues to outperform AAL.

- American Airlines Group (AAL) is executing the worst. Purchase Intent mentions haven’t gained momentum at the rate of LUV or DAL, and Consumer Happiness is the lowest (30% positive) due to flight delays, cancellations, and overall poor customer service experiences.

I talked about this in detail on the TD Ameritrade Network earlier this week.

We’ve got our eyes on booking mentions moving forward, especially when it comes to corporate travel.

While consumers have control over leisure travel, business travel is dictated at the corporate level…

Right now, it’s clear LUV and DAL are taking the lead.

We’ll be monitoring these trends in real time for any shifts in consumer behavior, and for outperformance by major players in the field.

As always, when we see an opportunity in this sector, LikeFolio members will be the first to know.

Andy Swan,

Founder, LikeFolio