Is PTON Still a ‘Must Buy’ Stock?

On Thursday, Peloton (PTON) posted a “disappointing” earnings report, showing less profit than Wall Street expected and announcing a price cut to its base-model bike.

Could this short-term volatility be a long-term opportunity for savvy investors? Let’s dig into the data!

First of all, there are plenty of good reasons to be concerned about Peloton stock in the near term.

Design flaws are causing issues, recalls and repairs are running rampant, and after a booming 2020, the company is facing extremely difficult year-over-year comps.

Happy Customers

On the plus side, LikeFolio data shows that recalls and safety concerns have not impacted overall brand happiness.

In fact, Peloton Consumer Happiness has actually increased +2 points year-over-year to 86% positive, which is a full five points higher than fitness equipment provider Nautilus (NLS).

In addition, cancellation mention volume remains negligible (less than one mention per day), suggesting that once people commit to the Peloton experience, they get hooked.

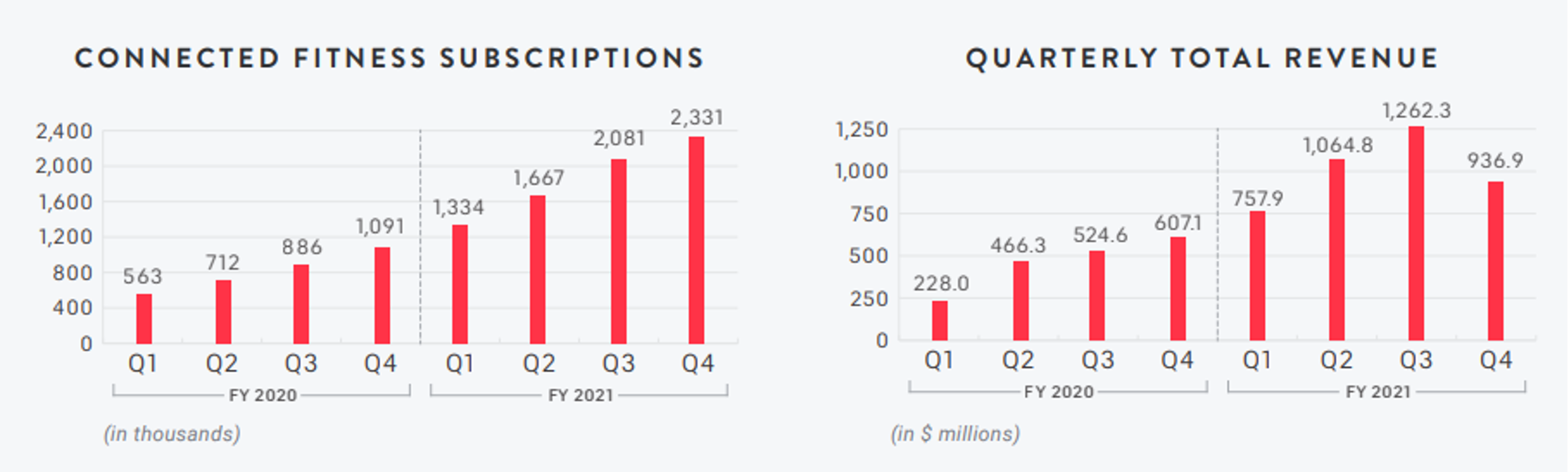

That’s great news for a company that relies on subscription revenue from its huge community of users. Keeping retention high will be a major factor in the company’s future profitability.

Last quarter, Peloton’s average net monthly “connected fitness” (i.e., subscription to a bike or treadmill) churn was just 0.73%, meaning more than 99.2% of users continued their subscription.

To give a goalpost, Netflix, Disney, and Apple streaming service churn rates fall between 2% and 15%.

Difficult Comparisons to 2020

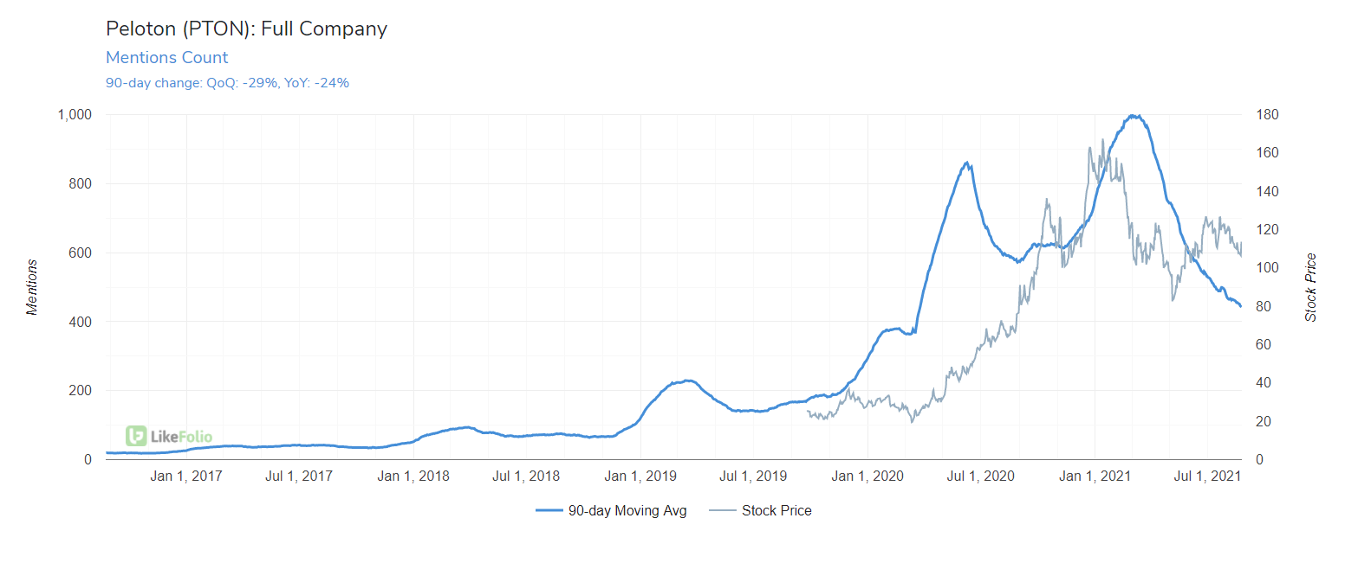

Another important LikeFolio metric to consider when gauging retention is mention volume.

Peloton mentions remain +171% higher than in 2019, though buzz has tempered compared with 2020’s work-out-from-home craze.

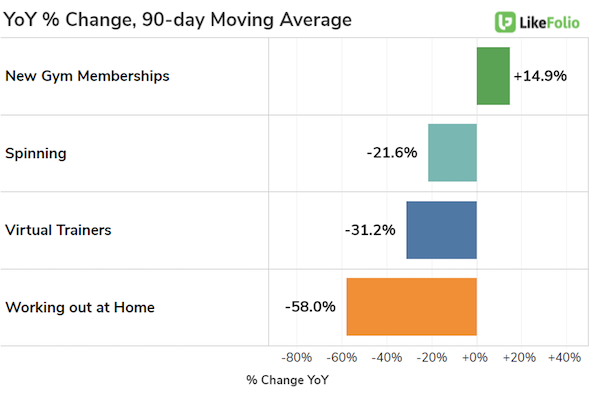

This theme is mirrored in overall fitness trends. Consumer mentions of using virtual trainers remain about 100% higher than in 2019 but are showing near-term signs of normalization.

In addition, data suggests some consumers are returning to the gym.

New gym membership mentions are +15% higher than last year.

But stay tuned here… any changes in reopening or mask guidance could quickly swing fitness trends back in Peloton’s favor.

The company is facing tough comps over the next few quarters, and investors will be laser focused on supply chain challenges and any impacts spurring from previously noted recalls and safety updates.

Summary

Long term, we still like this name, but we see choppy waters for the company over the remainder of 2021.

The practically nonexistent cancellation mention volume coupled with high levels of Consumer Happiness suggests a very happy consumer base.

But we wouldn’t be surprised to see a near-term correction, especially if connected fitness growth slows in a reopened environment.

That’s just the kind of opportunity we love to see.

As always, when consumer data suggests the time is right to get back in Peloton stock, LikeFolio members will be the first to know.

Andy Swan,

Founder, LikeFolio