The State of Crypto — A Look Back at 2021 and a Glance into the Future

Cryptocurrency represents a new frontier in the investing world.

And, it’s not just “a different kind of money” or “digital gold.” Distributed ledger (blockchain) technology offers novel solutions for legacy tech problems.

Everything moves fast in cyberspace, including the value of blockchain assets. We’ve seen some crazy ups and downs this year.

The crypto market started 2021 with less than $1 trillion worth of investment. That number had tripled by May (less than five months!) and then pulled back by -50% even faster.

Crypto investing is still the Wild West — not for the faint of heart.

However, we’ve remained steadfast in our bullish outlook throughout the year.

Why? Because our data clearly showed us that this time is different.

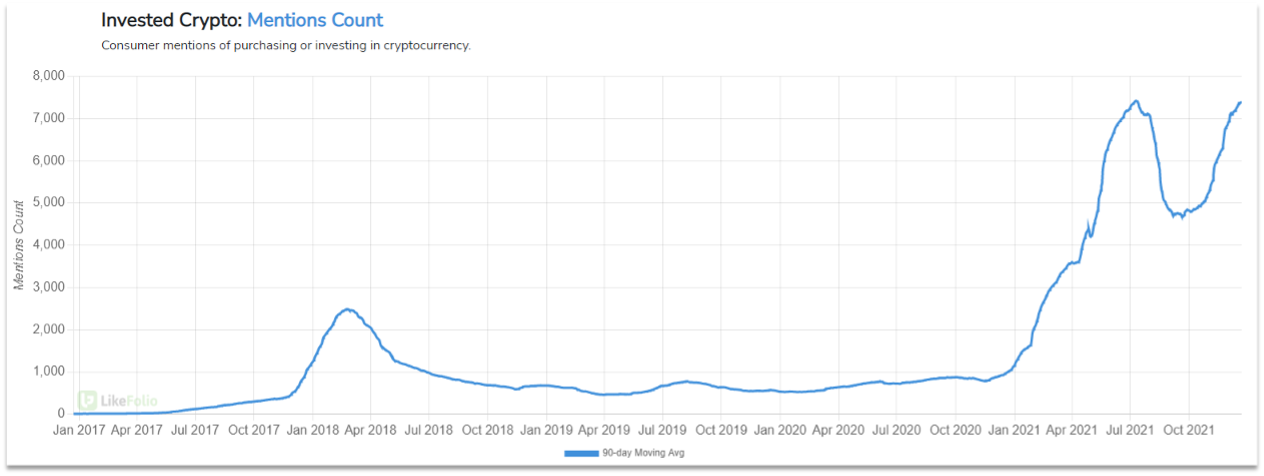

The number of individuals talking about investing in crypto exploded to new highs in 2021.

Unlike years past, that number has stayed higher.

To us, this was a clear signal that cryptos have entered a new stage in the adoption cycle.

Our confidence was only bolstered by a flood of investment capital into the space.

Tech companies like Tesla (TSLA) and Square (SQ) added Bitcoin to their balance sheet.

Coinbase (COIN), a cryptocurrency exchange, went public with an $86 billion valuation.

Even big banks have grudgingly started to invest.

These developments have all served to give the crypto space more legitimacy in the eyes of investors and the general public.

With hundreds of potential applications, thousands of projects, and new developments happening 24 hours a day, legacy media isn’t equipped to keep up with the fluid and time-sensitive market.

Luckily for us, crypto discourse is overrepresented on social media, giving our data a massive advantage, particularly when it comes to spotting the underlying trends driving investment.

The Biggest Crypto Trends of 2021

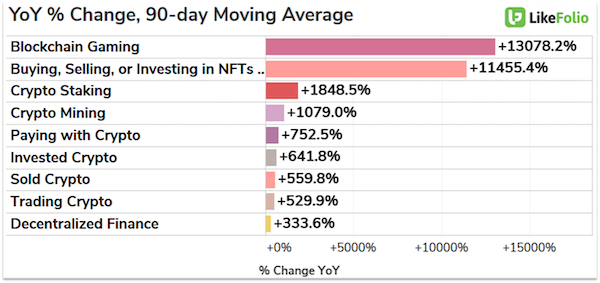

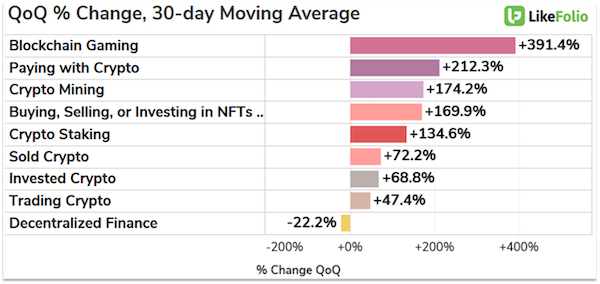

Over the past year, we’ve seen explosive growth for every single crypto-related trend.

A rising tide lifts all the ships, but that doesn’t mean there aren’t any outperformers within the crypto space.

In terms of year-over-year growth, there are two clear winners (and they’re related): Blockchain Gaming and non-fungible tokens (NFTs).

NFTs are Driving Blockchain Adoption

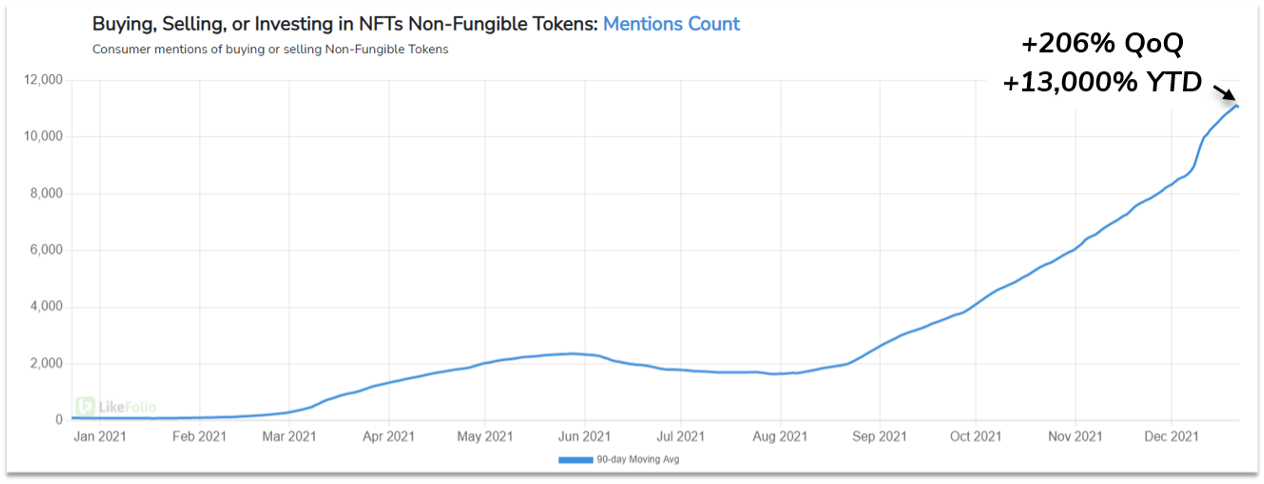

The rapid expansion of digital economies, the metaverse, the innate human desire to collect scarce and valuable assets… all of these factors are driving demand for a new kind of product, one that only exists in cyberspace: non-fungible tokens (NFTs).

Consumer Mentions of buying, selling, and investing in NFTs have soared to unbelievable heights: +13,000% year-to-date.

NFTs stand out as one of the few products of blockchain technology with both demonstrable value and widespread public awareness, making them a key driver of hype in the cryptocurrency space.

NFTs aren’t just expensive .JPG images either; we’ve only scratched the surface of their possible applications.

One application has already proved its value twice over: NFTs as in-game assets.

Blockchain Gaming: The Play-to-Earn Revolution

With the arrival of free-to-play hits like Fortnite, the gaming industry has taken a hard turn toward a new monetization strategy.

Instead of paying full price for a game with a uniform experience, players are encouraged to determine their own level of investment via in-game purchases (cosmetic items, extra features, and even performance upgrades).

Within the traditional paradigm, the “freemium” model still represents the same sunk cost of buying a full-priced game. There’s no secondary market for Fortnite skins.

Blockchain gaming changes that, by creating fluid in-game economies where players can cash out their investment or earn dividends.

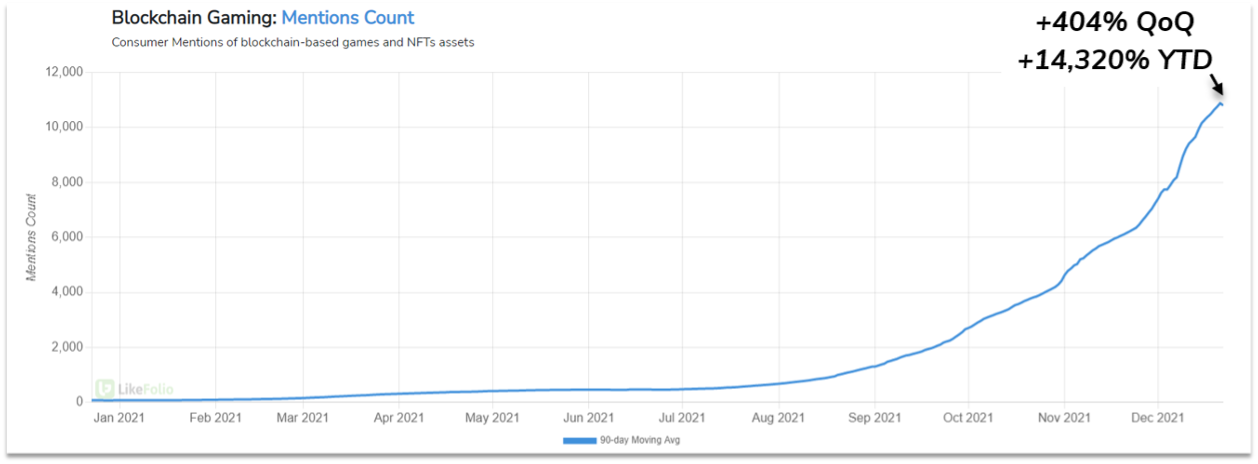

Mentions of blockchain-based games and play-to-earn mechanics have showed even more explosive growth than generic NFT investing.

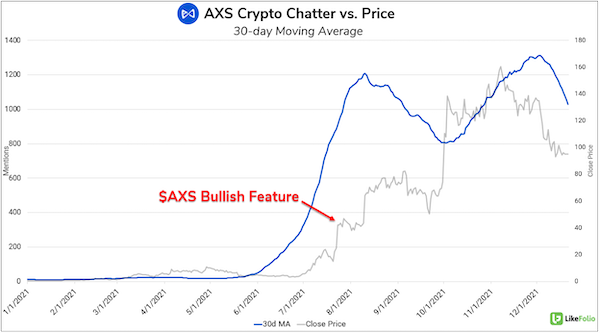

We noticed this trend incredibly early, thanks to Axie Infinity (AXS).

In late July, we suggested that Axie, an Ethereum-based game protocol, could become “more profitable than Pokémon.”

Since then, the price of the underlying AXS token has gained by more than 3x!

Why has it experienced such phenomenal gains? Because blockchain gaming creates value.

This may sound simplistic, but in the speculative realm of cryptocurrency, an active use-case (2.5 million monthly active users), and positive cash flow sets a project apart.

Axie’s success served as a proof-of-concept, and now there’s billions of dollars flowing into the newly minted blockchain gaming industry.

We’re still bullish on the space, but it’s not the only thing we’re excited for in 2022.

A Look Ahead

Near-term growth (QoQ) in the underlying trends shows that cryptocurrencies are still on the rise:

Blockchain gaming is still the hottest commodity, but consumers are also using their cryptocurrency to pay for goods and services.

The strength of this trend highlights the growing legitimacy of cryptocurrencies at large.

Perception is changing, and as adoption increases, cryptocurrencies are being viewed less as speculative investments and more as assets with utility (their true purpose).

Blockchain technology is still in its infancy, but we’re excited for what the future brings as the inevitable march toward Web 3.0 continues.

There’s no shortage of opportunities for investors with an ear to the ground and a healthy risk appetite!

Harrison Sweeney

Research Analyst, LikeFolio