Is the Gaming Boom Over?

One sector we’re most excited about for the upcoming earnings season is the gaming sector — specifically, video games.

LikeFolio data has been “ahead of the curve” on the gaming boom for more than a year, spotting big winners on everything from platform producers, development companies… and even headset makers.

But this earnings season, Wall Street won’t be paying attention only to historical results.

They will be focused on forward-looking guidance.

And what we’re seeing in the gaming industry right now could result in some massive, unexpected moves as earnings season gets underway.

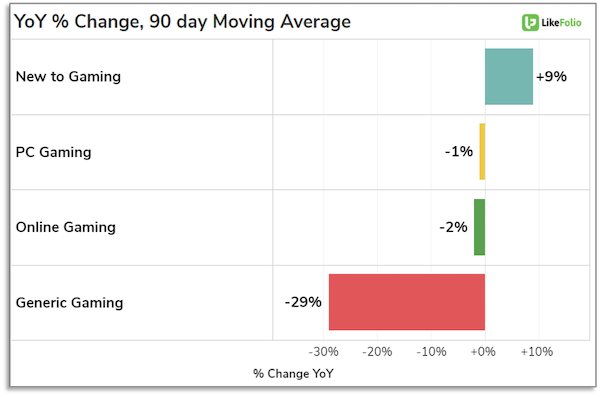

Macro: Gaming Trends are Cooling Off

Gaming mentions were surging at this time last year while consumers were locked inside, looking for new ways to entertain themselves.

Now that the country is starting to open back up, these trends are showing signs of normalization.

Gaming overall isn’t just down vs. its 2020 high, but also -9% lower vs. levels recorded in 2019.

While plenty of new consumers have picked up gaming, this trend is also tempering: first-time gaming mentions are down -15% QoQ.

Is this strain felt by major players in the gaming space?

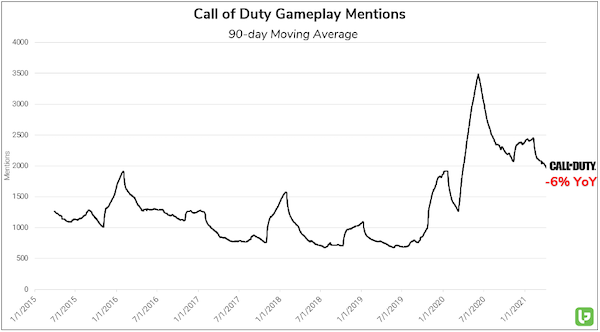

ATVI: Call of Duty has Bolstered Activision, but…

Activision received an enormous boost from a fortuitous Call of Duty: Warzone drop at the onset of quarantine last year.

The company received another demand surge in November when it strategically released Call of Duty: Black Ops Cold War immediately following the launch of the new Xbox and PlayStation consoles.

LikeFolio data shows that Call of Duty gameplay mentions are lower compared to last year’s surge (-6% YoY), but remain higher from a long-term perspective: +160% vs. 2019.

Collective ATVI demand fell -26% in 21Q4 (ended March 31), with Call of Duty outperforming other brand franchises.

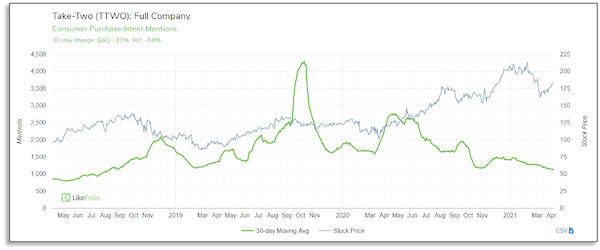

TTWO: NBA 2K Weakness is Weighing on Take-Two Interactive

NBA 2K gameplay mentions surged on release in September but have since failed to maintain momentum, currently pacing -54% YoY.

It’s interesting to watch this as NBA viewership slides…

TTWO’s Grand Theft Auto is performing slightly better vs franchise peers, but it may not be enough to buoy overall demand.

Overall, consumer demand for TTWO games and products fell -34% YoY in 21Q4 (ended March 31).

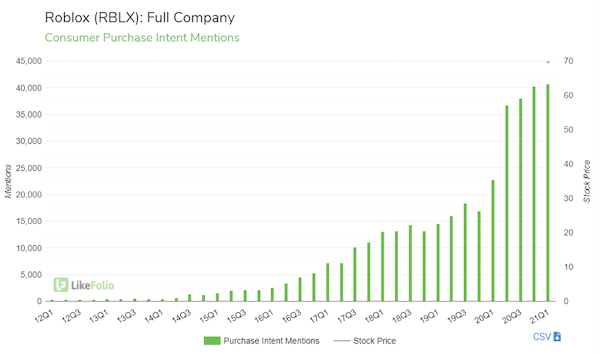

RBLX: Games Within the Roblox Universe are Continuing to Exhibit Strength

Roblox is one company bucking this overall gaming decline.

In fact, LikeFolio data shows Purchase Intent mentions reached new highs in 2021 and have increased +72% YoY on a 90-day moving average.

This kind of insight is critical during earnings season.

We want to know how the overall industry is doing AND the probable outlook for each company that will be reporting.

It will be critical to monitor consumer demand ahead of May earnings announcements for each of these companies.

We could be looking at some big profit opportunities, in different directions, on each of these stocks!

Andy Swan,

Founder, LikeFolio