Is TSLA’s Run Over?

At LikeFolio, we’ve been bullish on TSLA since our initial special Tesla report was released in April 2018, calling the stock “clearly a buy under (split adjusted) $60/share.”

Obviously, that has been a home-run investment, with TSLA stock moving as high as $900 per share earlier this year.

Since that all-time high, Tesla stock has fallen more than 37% as the Nasdaq and tech stocks have been hammered over the last month by valuation and growth concerns.

So… what is LikeFolio data telling us about Tesla now?

Consumer Macro Trends Are BIG Tailwinds

As always at LikeFolio, we like to start the research process with overall consumer macro trends. We want to know if the company is benefitting from overall consumer behavior, or if it is fighting an uphill battle.

For Tesla, two consumer macro trends are clearly telling us that the company has the wind at its back.

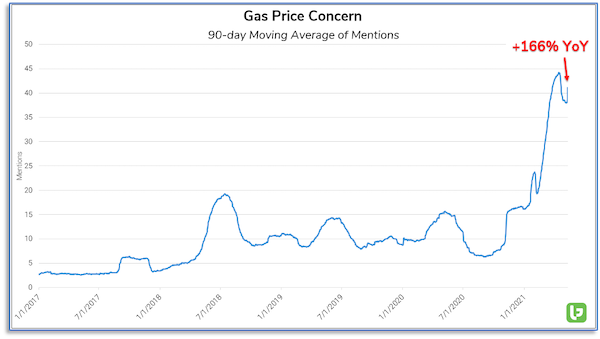

1. Gas prices are scaring consumers

For several years, gas prices have been an afterthought for the American consumer.

That is changing, fast.

The number of people expressing concern about gas prices has nearly tripled in 2021, and the recent shortages on the East Coast are not helping matters.

If prices remain elevated through the summer, we see more and more consumers taking a serious look at electric vehicles.

Speaking of which…

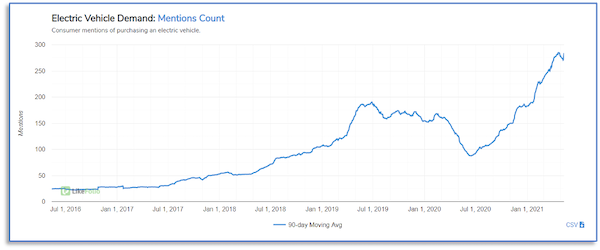

2. Electric vehicle demand is on the rise

We’re seeing demand for electric vehicles at all-time highs and expect to see this trend continue well into the future.

Competition Is Heating Up

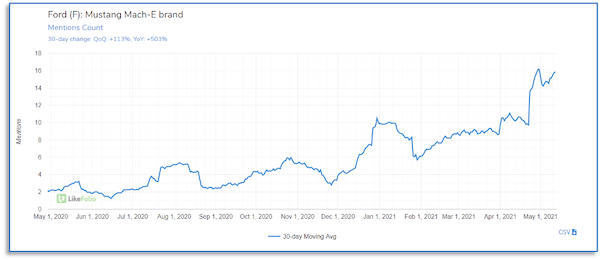

Of course, this surge in consumer demand isn’t only benefitting Tesla.

In fact, new players are entering the market at a blistering pace.

Even Ford’s traditional muscle car, the Mustang, has gotten into the game with the Mach-E electric version, which has been met with a positive consumer reaction.

But this rise in competition is not necessarily a negative for Tesla.

The normalization of electric vehicles will bring more people into the market, which means an expanding base for Tesla to appeal to.

This shift in consumer thinking could benefit Tesla in a big way, given the company has consistently shown the ability to win the consumer’s ultimate decision on which electric vehicle to buy.

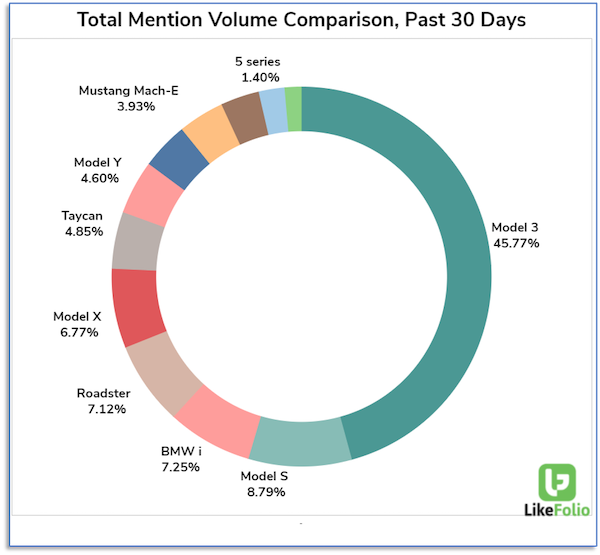

One look at the chart above and you can see just how much Tesla is dominating the competition, with more than 65% of the total mention volume of the entire electric vehicle market.

In other words — the more competition Tesla gets, the more consumers Tesla wins!

Demand for Tesla Products Is Still Very High

LikeFolio Consumer Purchase Intent Mentions are a real-time measure of consumer demand for the products and services of a company. It’s how we know what’s going on with consumers on Main Street, before it becomes news on Wall Street.

For Tesla, this data has proven to be invaluable, historically. As you can see from the chart below, purchase intent mentions (green line) have been a fantastic leading indicator of TSLA stock price (grey line).

You’ll also notice from the chart above that Tesla’s consumer demand numbers are currently sitting near all-time highs, a great sign for the company moving forward.

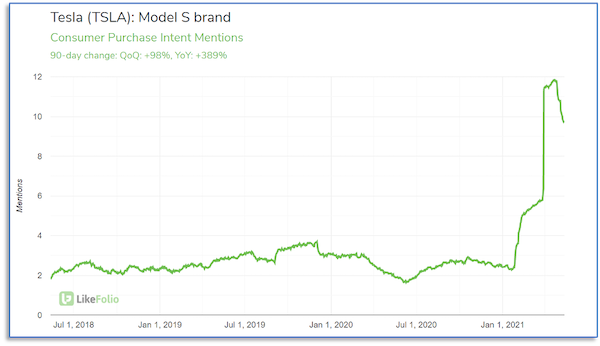

On a brand level, things look even better for Tesla, as the company’s latest “refresh” of its expensive Model S brand has generated enormous consumer demand.

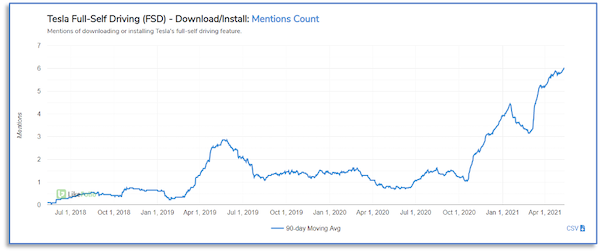

Another clue that Tesla is well-positioned comes from one of the revenue-drivers that excites me most, because it’s one that Wall Street often overlooks: Demand for Tesla’s Full Self-Driving (FSD) software.

As you can see from the chart above, consumers are beginning to pay attention to Tesla’s FSD in a big way.

This is important because, not only is the feature a high-margin upgrade for new car purchases, but it’s also available for purchase via software download to hundreds of thousands of Tesla vehicles already on the road.

We expect that once FSD functionality is out of “beta” and available to the masses, Tesla will see an enormous influx of extremely high-margin revenue via these upgrades.

Long story short — demand for Tesla cars is popping, and consumers are flocking to their most lucrative brands and features.

Summary — Tesla Stock Is Expensive for A Reason

At LikeFolio, we’ve been bullish on Tesla for more than three years now. Not once have we said the stock was “cheap” or a value play. Because it’s not.

The stock is expensive by any historical measure or ratio you want to use.

But it should be expensive, because the growth potential is incredibly high.

And if there is one thing we’ve learned over the years… from AAPL to NFLX to TSLA… it’s that expensive stocks can stay expensive for a long, long time, and make investors a ton of money along the way.

Andy Swan,

Founder, LikeFolio