Netflix Earnings Preview (NFLX)

It’s my favorite time of the year again.

Earnings season is cranking up!

Tomorrow at 7 p.m. Eastern, I’ll send Earnings Season Pass members our famous Sunday Earnings Sheet. With more than 10 specific trade opportunities seeking profits of 100% or more in just five days, it’s a doozy.

And one of my favorite companies to trade is on the sheet this week: Netflix (NFLX).

So I wanted to give you an early peek at how the data is shaking up.

At LikeFolio, we listen to what matters to consumers on social media. Are they subscribing to Netflix? Is HBO Max a better option? And what in the world is “Squid Game”?

This real-time pulse check gives us a serious edge ahead of earnings.

We use all of these powerful consumer insights to generate a proprietary Earnings Score for every company we cover.

Just 10 days ago, our Earnings Score for NFLX would have been neutral. But now we are getting an actionable signal on the stock… just in time for the company’s earnings release on Tuesday.

That’s quite a shift in a week.

What’s going on?

Netflix is ramping up original content releases as the weather cools down… and consumers are loving it.

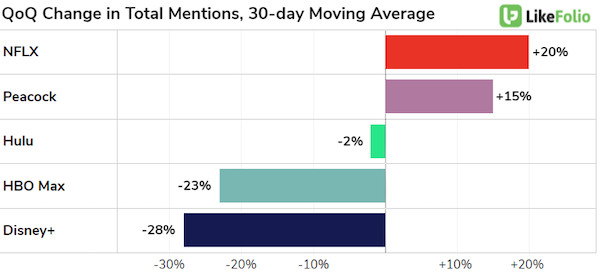

Netflix is recording more buzz momentum this quarter than its streaming peers.

Mentions of Netflix or one of its original titles have increased by +20% this quarter.

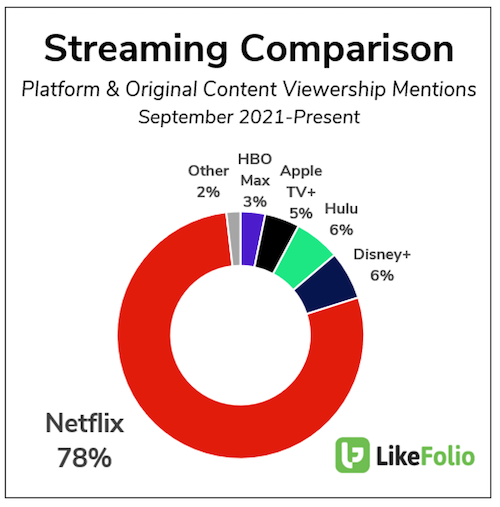

Netflix’s expanded content library, featuring syndicated names like “Seinfeld” and new content drops like “Squid Game,” is increasing its dominance in overall viewership mentions.

Consider the chart below, showcasing viewership mentions for platforms themselves, like “watching Netflix,” and for original content streaming, like “can’t stop watching Squid Game.”

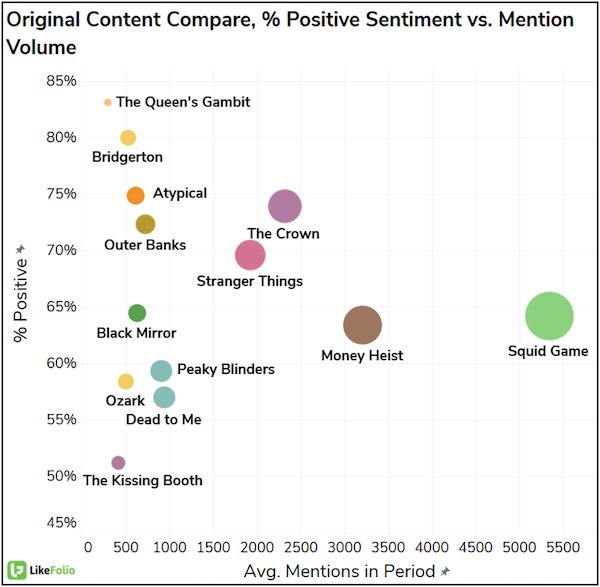

Speaking of “Squid Game,” Netflix reported that the South Korean drama is its “biggest-ever series at launch.”

You can see how much buzz this series is receiving, even from English-speaking viewers, on the scatter chart below.

This chart showcases mention volume for original content series alongside happiness for Netflix content since August.

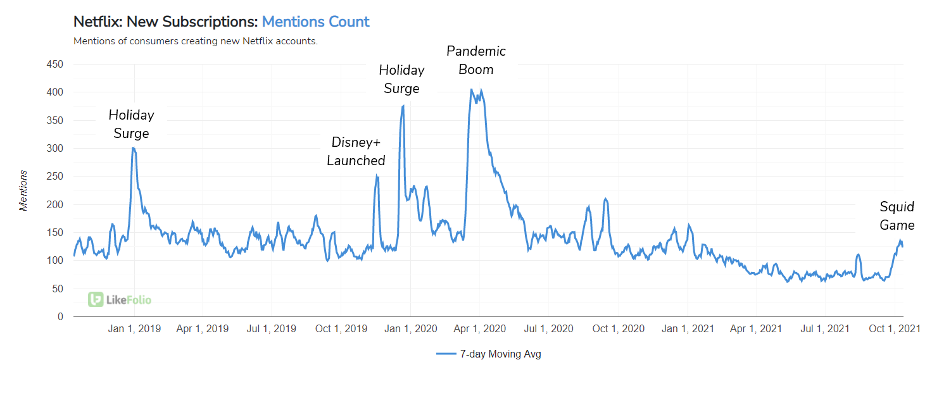

More importantly, we know original content is what moves the needle when it comes to user retention and new membership.

Not only are Netflix cancellation mentions continuing a multi-month downtrend, but we saw the first significant new subscription spike for Netflix since the pandemic.

While Netflix user growth has slowed compared to its early days, initial consumer data heading into a critical streaming season shows signs of improvement.

We’ll be monitoring through the end of the year to see if upcoming content drops can continue this positive trend for NFLX.

But for Tuesday’s earnings report, it’s game on.

In fact, the Earnings Score for NFLX in the upcoming week has warranted one of my absolute favorite trade setups. This strategy strictly limits risk and seeks a 100%-plus profit.

All with a Monday entry and a Friday exit.

I can’t wait to share this trade setup, plus at least 10 more specific opportunities, tomorrow night at 7 p.m.

That’s when I will send out both the Earnings cheat sheet for the week and my nearly hour-long video roundtable discussion of the opportunities and trades for the week ahead!

Andy Swan,

Founder, LikeFolio