When the Mainstream News Makes Broad Generalizations, We Uncover Ways to Make Money

When I traipse out onto my front porch with my morning blonde roast to fetch my Wall Street Journal, the headlines for the day always seem to paint a darkening scenario for the world.

From the war in Ukraine to rocketing gas prices to rising inflation, the stress level is palpable.

At LikeFolio, we’re watching closely for indicators that the consumer is getting stressed and modifying their spending habits with everything that is happening.

Consider the rise (and fall) of consumer mentions related to economic fears and behaviors:

- Inflation fears: +370% YoY

- Gas price concerns: +440% YoY

- Rising interest rates: +323% YoY

- Maxed-out credit card: +9% YoY

- Paid-off credit card: -45% YoY

Inflation fears, gas price concerns, and mentions of rising interest rates are at all-time highs. But then I think about my weekend…

Traveling to meet friends for a birthday celebration. Shopping. Dinner. Drinks. Ubers.

It feels so different from the world I see in my morning paper and on my Twitter feed.

And it turns out, according to LikeFolio data, consumers are certainly aware of economic pressures but are still spending…

Consumers Are Splurging on High-Quality Apparel and Experiences

Today, I want to zoom in on one area: retail.

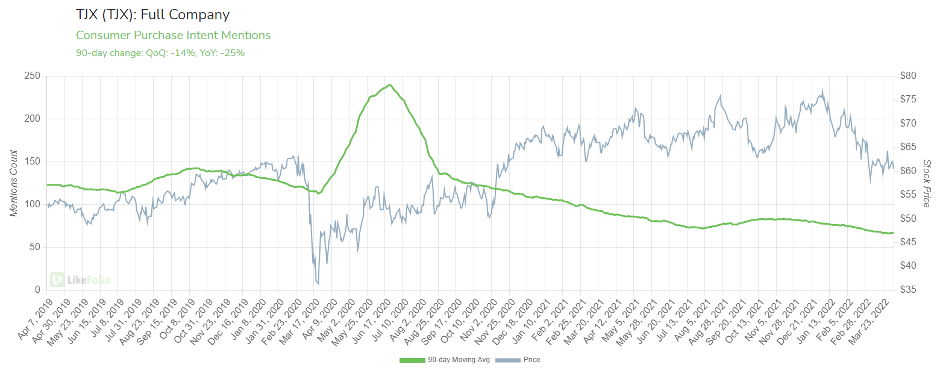

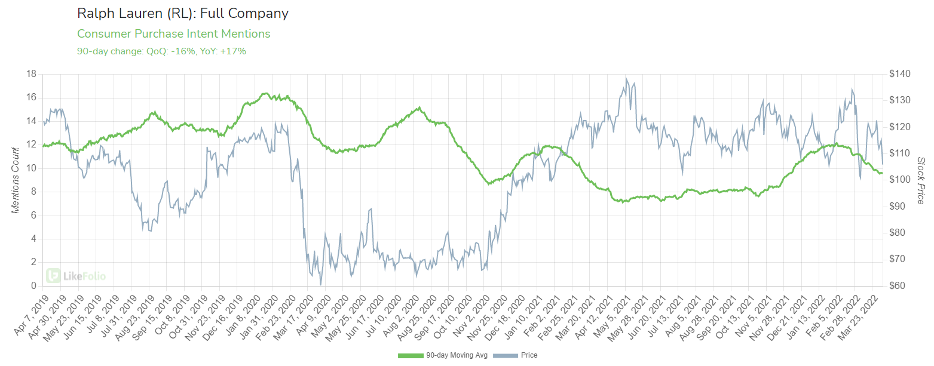

Earlier this week, Ralph Lauren Corp. (RL) and TJX Cos. (TJX) were downgraded by analysts who see challenges ahead from inflationary pressure in 2022.

But LikeFolio data suggests not all retailers are created equal… and consumers aren’t feeling the burn quite yet.

1. High-End Brand Names Are Showing Near-Term Strength

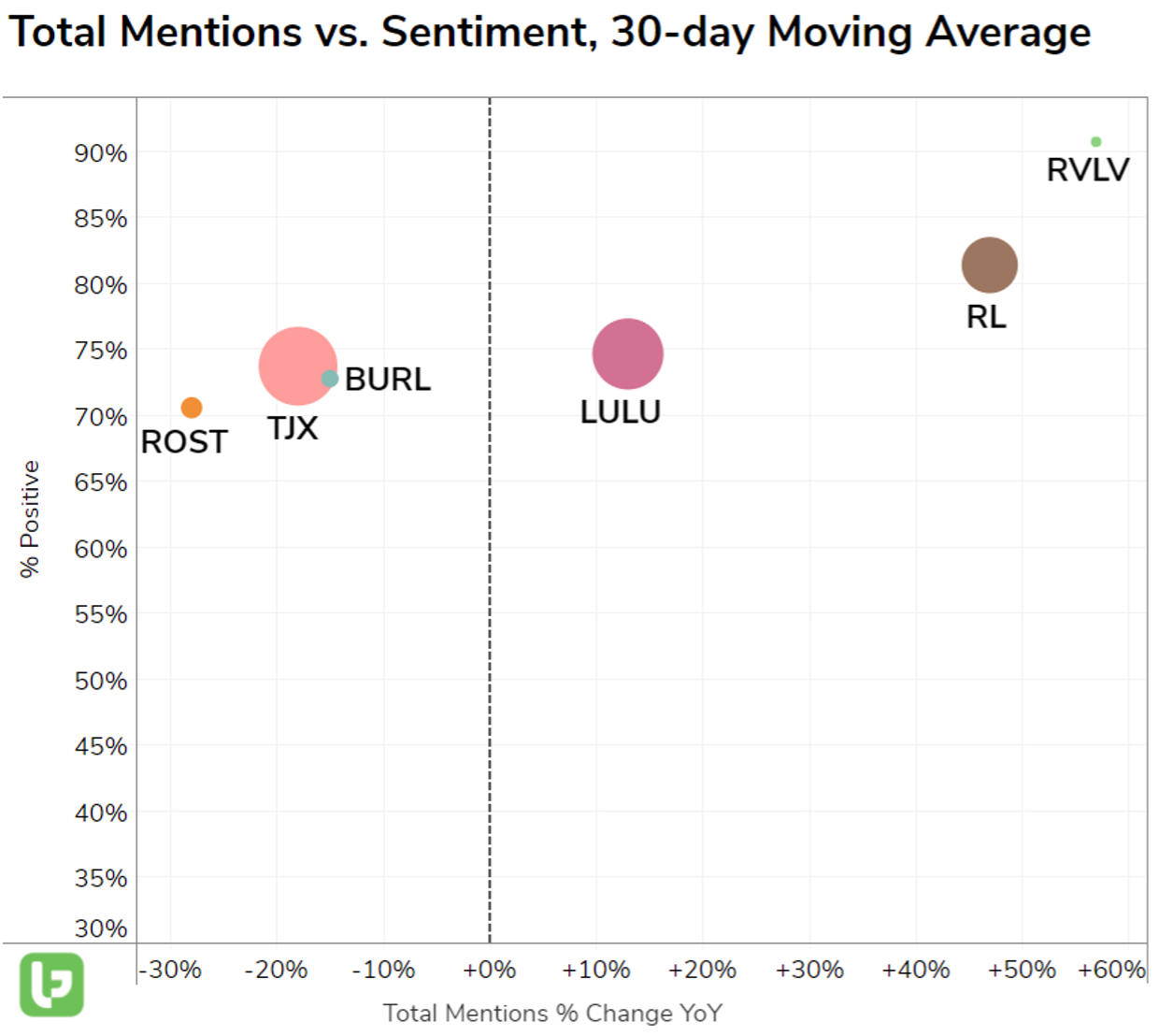

According to social media mentions, in the last quarter, consumers have been seeking out apparel from Ralph Lauren, Lululemon (LULU), and even high-fashion brands from Revolve Group’s (RVLV) e-commerce site.

In contrast, discount retailers like TJ Maxx, Ross Stores (ROST), and Burlington (BURL) are recording year-over-year weakness in consumer demand.

This seems counter to the picture painted by news outlets, but again, our data can speak for itself.

You can see the dotted line in the sand in buzz growth on the chart above. To be clear, if you’re a retailer, you want to be on the right side of that chart, and the closer to the top you are, the better.

2. Shopping Habits Confirm Consumers Are Still Spending

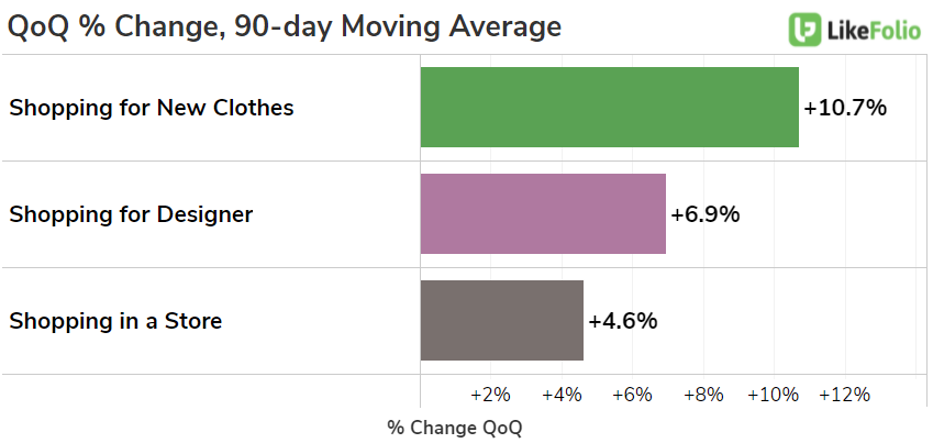

Perhaps this retail apparel splurge is being driven by all the trips and social events consumers are attending after two-plus years of being stuck inside.

After all, mentions of shopping in a store and shopping for designer items are rising on a quarter-over-quarter basis.

If consumers were at their breaking point, we would expect to see weakness for more expensive brands.

These company-level and macro-level data points are powerful indicators for investors to use in finding profit opportunities.

It shows us in real time when and where consumers are shopping.

And thanks to company-level comparisons, we know that when analyzing retailers, you can’t lump all their performances together. With our “cheat sheet” (LikeFolio data), we have an edge:

- LikeFolio data does support a more neutral — or trade-adverse — position for TJ Maxx due to its waning demand growth.

- In contrast, LikeFolio data suggests Ralph Lauren may end up surprising investors. If earnings were this week, the company’s score would be +66 – pretty bullish in our universe.

Keep an eye on both companies moving forward to see when and where apparel spending begins to wane if consumers do reach a breaking point.

But so far, Ralph Lauren and high-quality peers are looking much stronger compared to their discount retail counterparts.

I love having a cheat sheet.

Megan Brantley

Head of Research, LikeFolio