A Name Change Alone Isn’t Enough for Facebook to Win the Metaverse

At the start of this year, I wrote about Facebook and how its 2014 purchase of the virtual reality (VR) headset maker Oculus VR Inc. for $2 billion will be essential for the company moving forward.

That’s because, for the first time in 17 years, Facebook reported that its total number of users declined in Q4 2021, and it will need to look for ways to increase its user base and make more money.

With what could be seen as a preemptive response to the issue of a declining user base, CEO Mark Zuckerberg announced in October 2021 that he was changing his company’s vision, as well as changing the company’s name to Meta Platforms Inc. (FB).

In his company’s press release, Zuckerberg said:

“To reflect who we are and the future we hope to build, I’m proud to share that our company is now Meta. Our mission remains the same — it’s still about bringing people together. Our apps and their brands aren’t changing either. We’re still the company that designs technology around people. But all of our products, including our apps, now share a new vision: to help bring the metaverse to life. And now we have a name that reflects the breadth of what we do.”

Facebook’s Oculus Quest headsets will fit into that vision, as they will connect people to virtual worlds and Zuckerberg’s metaverse creations.

Heading into the holiday shopping season, Oculus brand mentions skyrocketed, with the Oculus app shooting to the top of the App Store and Google Play charts at one point.

But there’s something to know about the headsets…

John Carmack, chief technology officer of Oculus VR, has explained that the company sells the headsets at a loss or breakeven. It’s the entry point to get people to pay for the products and services Meta will offer in the metaverse.

So, what does Meta need to make its VR products a success and get people connected in the metaverse?

User retention.

Keeping users engaged in the product is the key for the company and something it has struggled to achieve.

Meta is looking for ways to keep headset users engaged, previously testing out the launch of the virtual reality version of the game “Resident Evil 4.”

Furthermore, Zuckerberg said recently that the company is testing tools that allow creators to sell virtual assets on “Horizon Worlds,” a free virtual reality video game available to people in North America.

While it is yet to be seen whether the tools being tested will work, recent consumer data suggests Meta’s metaverse is still struggling to retain users…

Usage Tumbling

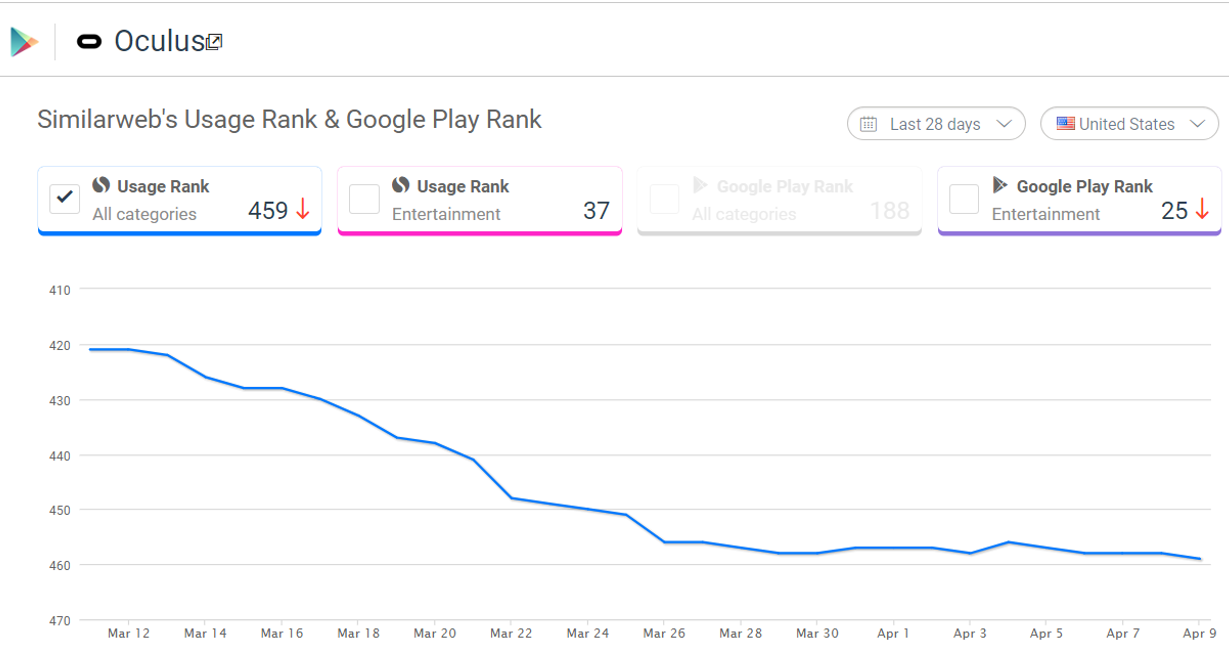

In the chart above, from SimilarWeb, you can see the Oculus app usage rank on the Google Play store for the last 28 days…

Not good.

Usage has tumbled since the initial Christmas frenzy, and according to data, its usage rank is now at 459 across all categories.

For the iOS App Store, Oculus now ranks all the way down at 187… a swift fall from its peak as the top app over the holiday period.

In the entertainment category alone, the company is performing reasonably well, ranking at 17 on the App Store and 25 on Google Play (rankings are for the U.S. only).

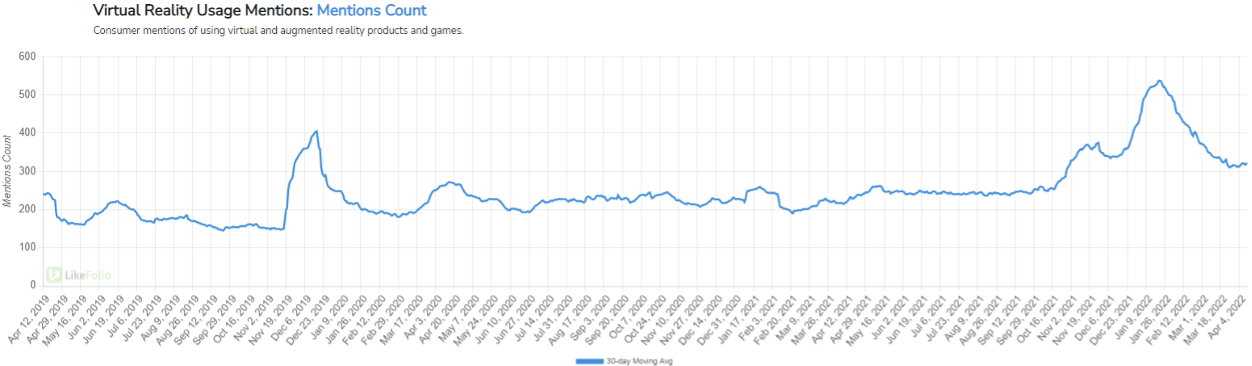

The recent decline in app usage data aligns with a key trend we track at LikeFolio — virtual reality usage mentions.

After a surge from late October to late January, consumer mentions of using virtual and augmented reality products and games are now on the slide, trending at -37% quarter-over-quarter (QoQ), with year-over-year (YoY) numbers pulling back to just 48% growth.

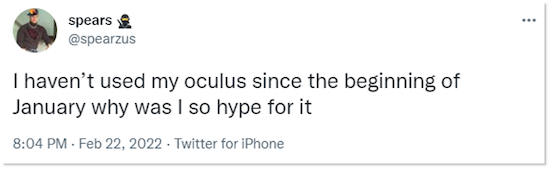

Back in January, Facebook leadership said there were plenty of headsets in closets or ones that are not regularly being used, describing the buyers as “lapsed VR users.”

Clearly, there’s something holding people back from using the headsets, but Meta is still at the drawing board to figure out how to take people from “lapsed VR users” to “active VR users.”

Consumer Demand Waning

LikeFolio’s Consumer Purchase Intent tells a similar story…

The rise through the Christmas period was met with a decline soon after.

In the chart below, we can see just how sharp that decline is…

Consumer demand levels for Oculus VR headsets are currently trending at -67% QoQ.

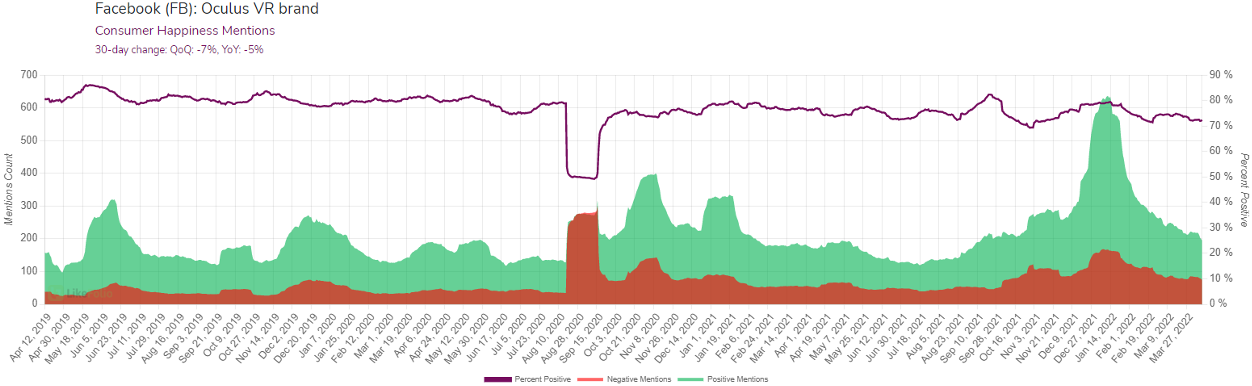

Along with some degree of seasonality, another reason for this cooldown may be the declining levels of consumer happiness with the product.

Along with usage, consumer happiness for Meta’s Oculus headsets has also dipped, trending at -7% QoQ and -5% YoY, suggesting people have maybe become a little bored and even frustrated with their headsets since the holidays.

With usage, demand, and happiness declining for a couple of months after the Christmas boom, all signs suggest that Meta still has some way to go on its retention challenge and making money through the metaverse.

With that said, for Zuckerberg, this is a long-term bet on the metaverse, which is expected to climb in value from $21 billion in 2020 to $678 billion by 2030.

As always, LikeFolio clients will be the first to know when we see major shifts in consumer adoption of metaverse technologies and services.

Andy Swan

Founder, LikeFolio