Fast-Casual Stocks Look Tasty

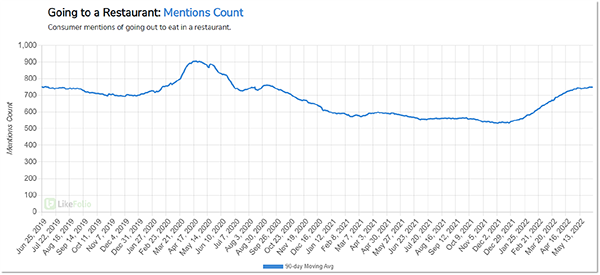

Dining out took a major hit during the pandemic.

An estimated 90,000 restaurants shut down, and 5.9 million workers lost their jobs.

But as Michael Scott, Steve Carell’s character from the hit show “The Office,” would say, “Well, well, well. How the turn tables…”

The dining consumer has come out of hibernation. Mentions of going to a restaurant are trending up 30% YoY, the highest point since spring 2020.

U.S. census data released in May showed that restaurants continued to grow their share of spending in April, accounting for 54.9% of Americans’ spending on food, an all-time monthly high.

But there’s a particular segment of the restaurant sector that is outperforming: fast casual.

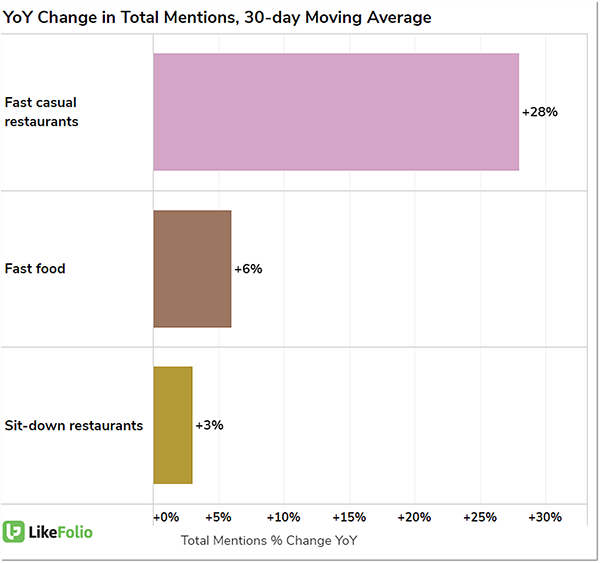

The chart below segments mention volume growth for each food service type (fast casual, fast food, sit-down) in the LikeFolio ecosystem so we can analyze sector performance.

It’s clear fast-casual names are building momentum with consumers.

Cheaper and quicker than a sit-down restaurant experience, and higher quality than fast food, fast-casual options appear to be the sweet spot for consumers in a high-inflation environment.

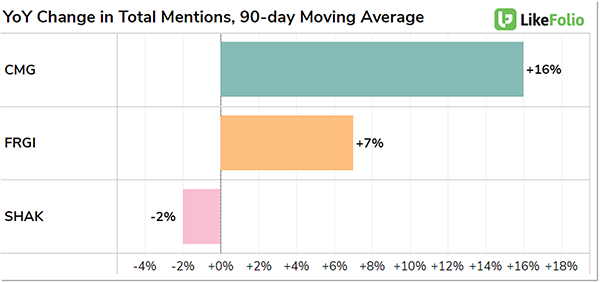

Companies such as Shake Shack (SHAK) and Fiesta Restaurant Group (FRGI) are performing well in the LikeFolio universe, but Chipotle (CMG), which recently announced it will accept cryptocurrency payments in the U.S., is shining.

Here is what is driving Chipotle’s relative outperformance…

Burritos Are Hot… and Customizable

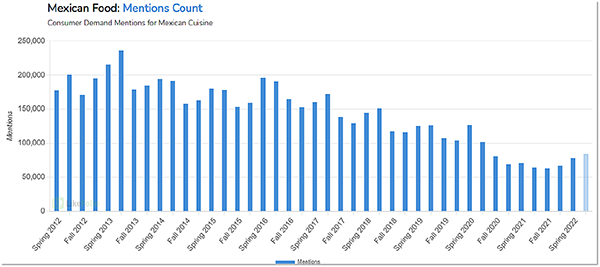

The number of consumers talking about Mexican cuisine is rising for the third period in a row.

After a drop-off over the last few years, Mexican food mentions are trending up 10% QoQ and 34% YoY.

Aside from being a trendy cuisine, Chipotle’s customizable menu options allow for easily personalized diet recommendations, for high-protein followers and vegan dieters alike.

Consumer Buzz Is Gaining Steam

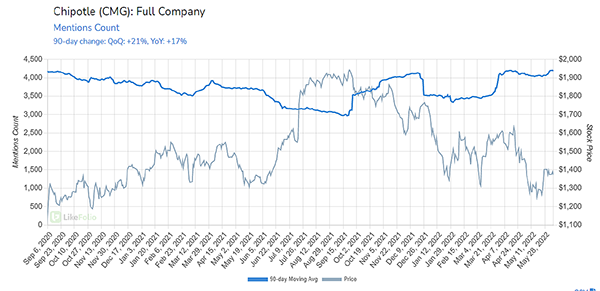

Overall consumer mentions of Chipotle are on the rise, pacing 17% higher YoY.

In its first-quarter earnings report, the company said it saw very little resistance to price rises, which were up around 10% YoY, demonstrating the strength of consumer loyalty to the brand.

Demand Is Picking Up Momentum

Most importantly, mentions from consumers eating Chipotle are accelerating. We can see this by examining moving averages. Demand growth in the last quarter (90 days) is pacing 8% higher YoY. But demand growth over the last month (30 days) is pacing 17% higher YoY.

And Chipotle Consumer Happiness levels have actually increased by 2% in the same time frame… a rare occurrence in the LikeFolio universe.

All of these factors suggest that Chipotle is hitting the mark with consumers.

The inflationary environment may be pricing some consumers out of formal sit-down restaurants, but it doesn’t seem to be deterring them from fast-casual names like Chipotle.

With CMG shares down roughly 20% in 2022, a strong LikeFolio historical predictiveness score, and positive consumer metrics, Chipotle stock is looking more and more appetizing.

We’ll be tracking Chipotle and other fast-casual dining names in real time. And LikeFolio members will be the first to know when opportunity is ripe for the taking.

Megan Brantley

Head of Research, LikeFolio