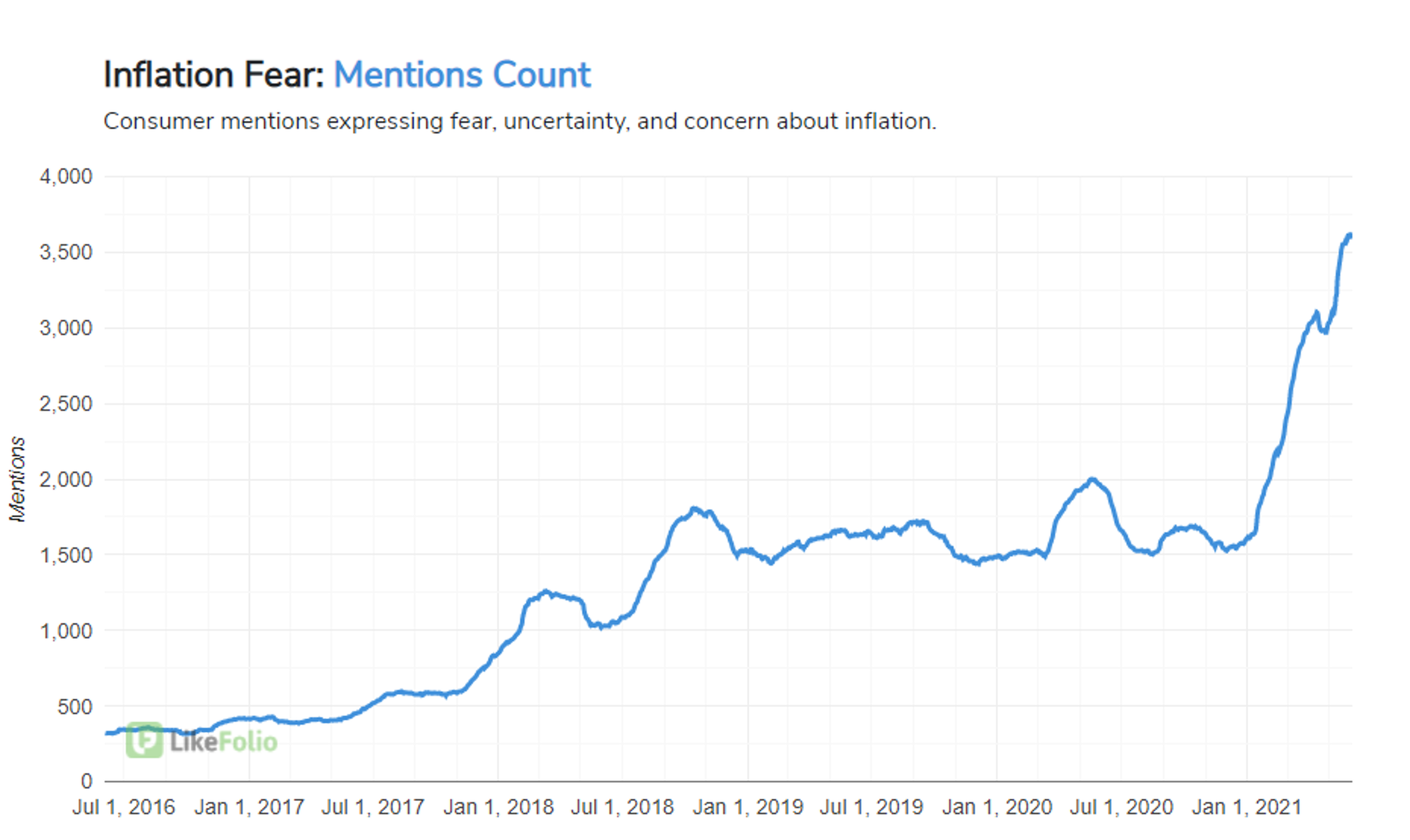

Inflation Fears are Mounting

Inflation fears are mounting.

One look at LikeFolio trend data makes this clear:

And who can blame them?

Prices of houses and used cars are skyrocketing while grocery trips get more expensive.

Some blame supply chains, others blame the printing press, but that’s not our concern here.

We want to know what assets are benefitting from these inflation fears.

Today, I want to take a look at two types of assets that may seem extremely different on paper — but share the common feature of being a hedge against future inflation.

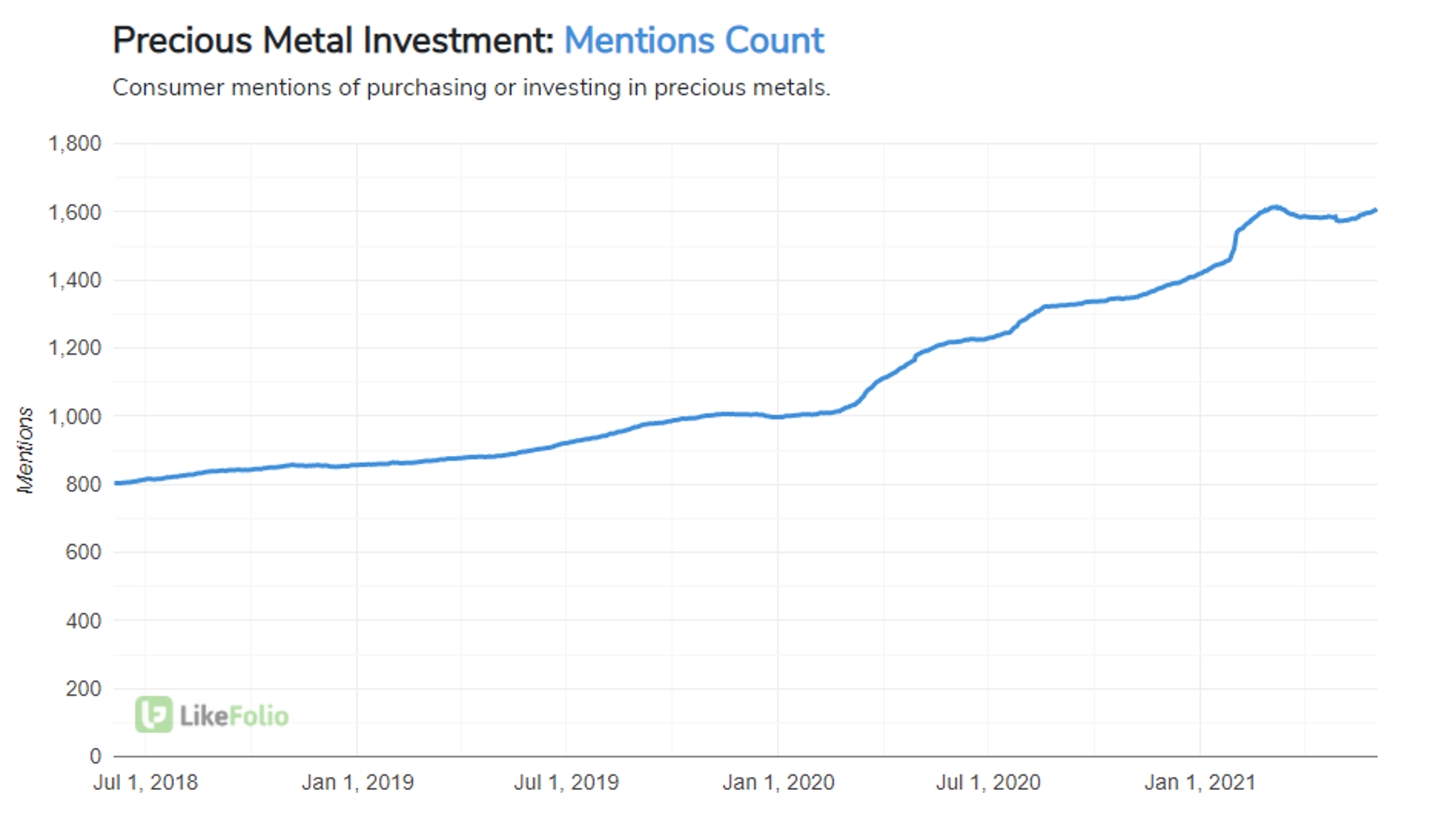

Precious Metals

First, start with the obvious.

Precious metals have been the safe haven against currency fears for centuries.

And, it turns out, interest in investing in these assets has more than doubled over the past three years:

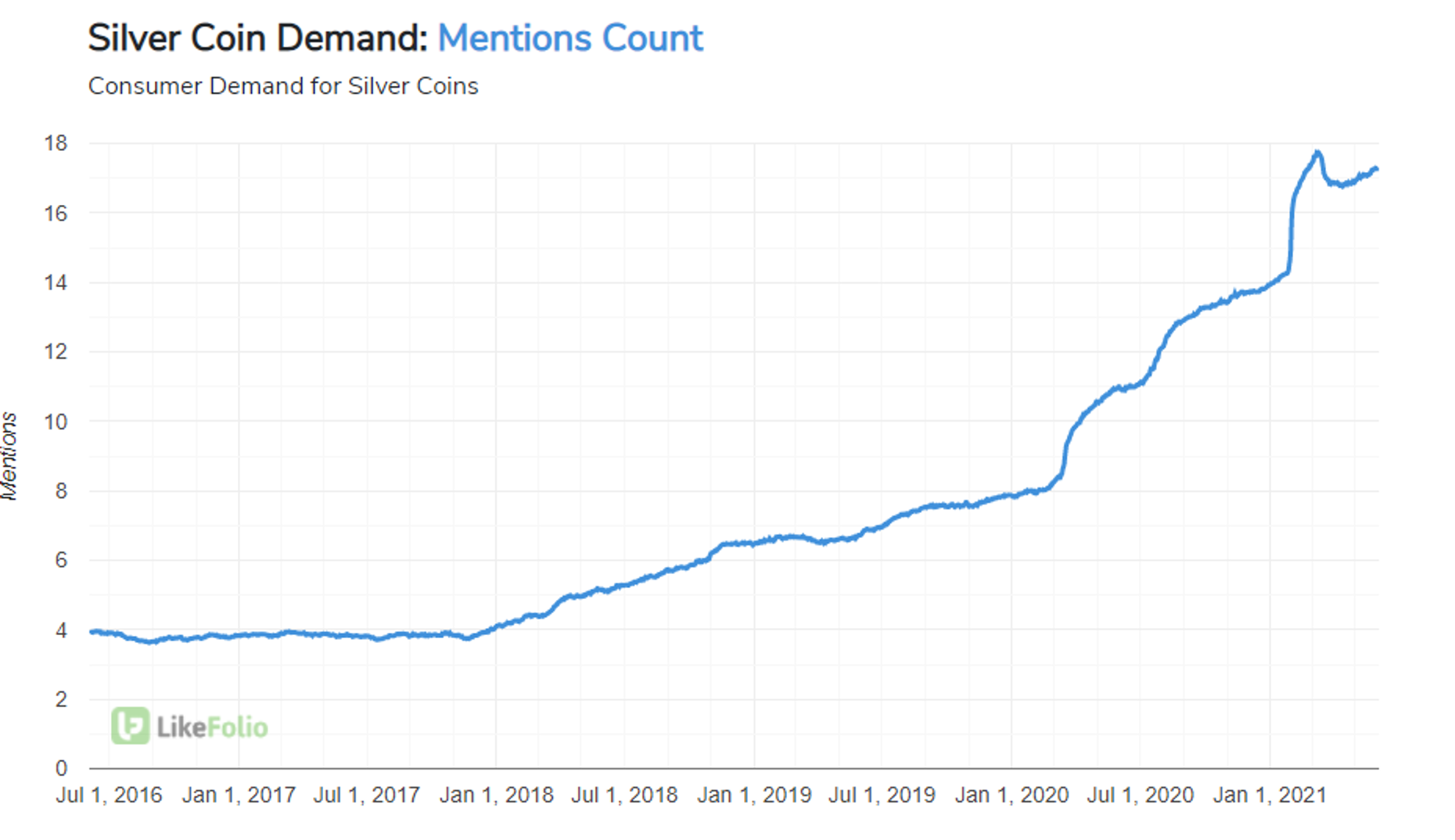

Silver especially is coming into the spotlight lately.

Last week, the U.S. Mint alerted customers via email that a “global silver shortage has driven demand for many of our bullion and numismatic products to record heights.”

LikeFolio data confirms this phenomenon — Retail Investment Demand for Silver Coins is surging, +75% YoY on a 365-day moving average.

This trend has been steadily rising since early 2020, hitting a record high during the “silver squeeze” event in early 2021.

Despite the massive influx of consumers clamoring to purchase coins, the price of Silver futures contracts (SI=F) has not kept pace in recent months.

The 365-day moving average of Mentions shows that Demand for silver coins first began to swell during the COVID-induced sell-off in March last year. Silver futures proceeded to soar higher as the COMEX faced a historic number of silver contract deliveries in July.

The retail supply of silver coins has only tightened since then… American Silver Eagles, the official silver coin of the U.S. Mint, command a premium of +40% above spot price at minimum.

Premiums for silver bullion products are historically high across the board, and with Investor Demand for silver coins showing continued strength, another record July delivery month could be forthcoming.

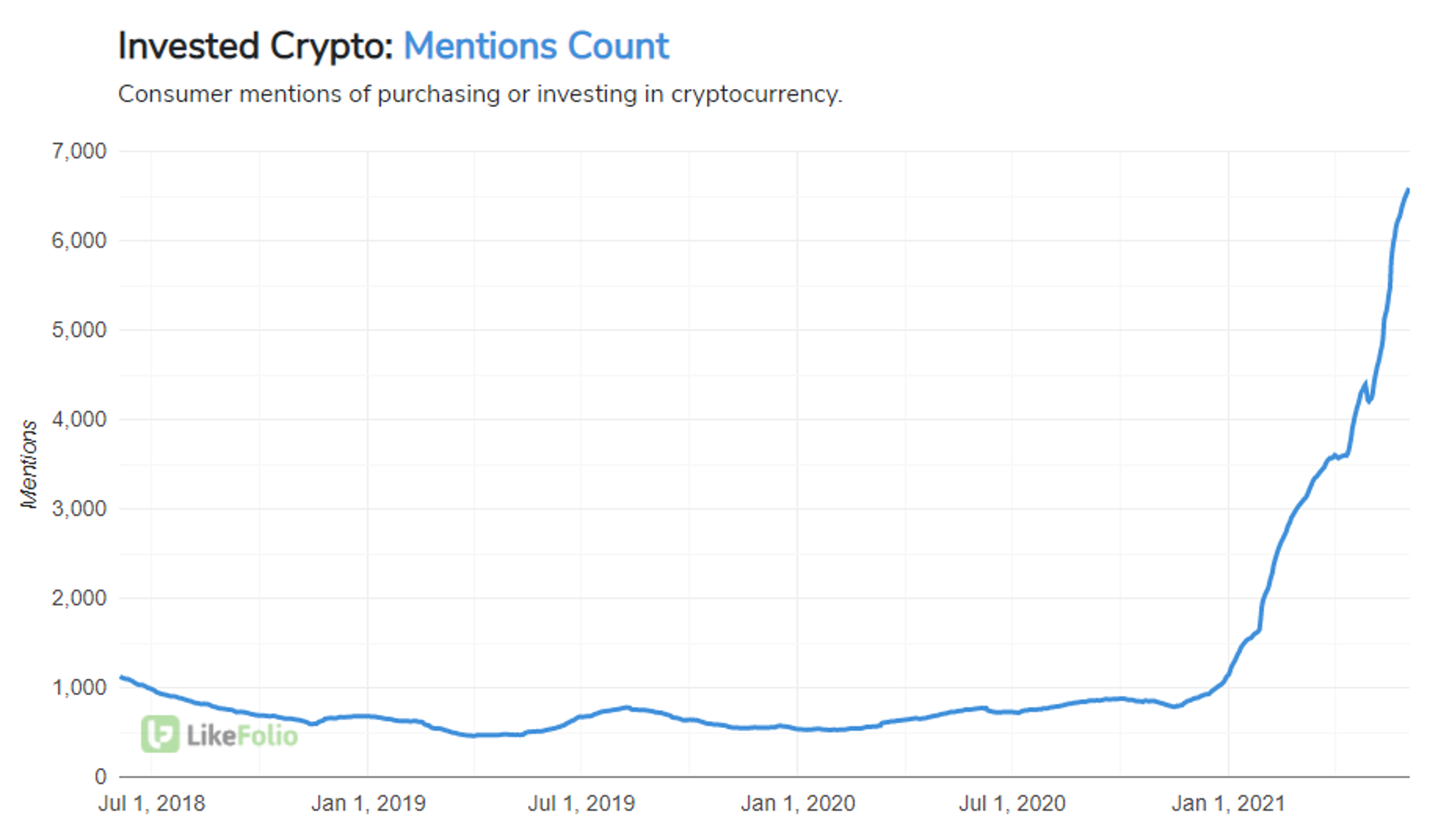

Cryptocurrencies

But precious metals aren’t the only outlet for worried money-holders.

There’s a new kid on the block.

Cryptocurrencies like Bitcoin were originally designed to be a digital replacement for gold.

By having a limited quantity and mining functions that get more difficult as undiscovered supply dwindles, Bitcoin was able to replicate the “store of value” functionality of gold, while providing additional benefits such as a distributed ledger and blockchain technology that provided an immutable proof of historical ownership.

Naturally, cryptocurrency investing is taking off as fears of inflation rise:

Bitcoin is the natural, first-mover leader here, with functionality very similar to precious metals from a “store of value” perspective.

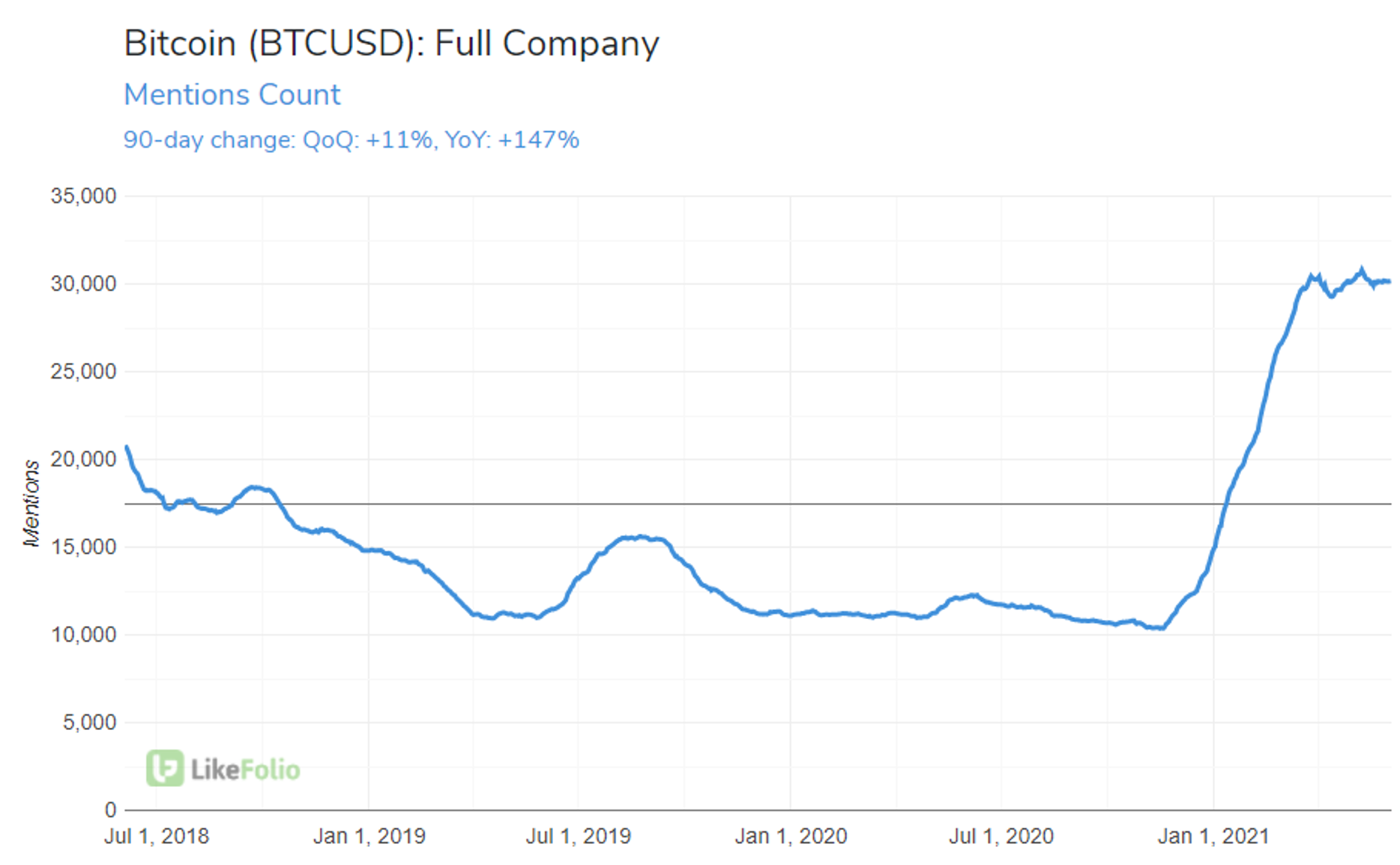

And interest in investing in Bitcoin is rising quickly, as expected:

But just like in precious metals, there isn’t just one player.

Alternate cryptocurrencies are being developed all the time, each with a unique twist of functionality or features that they hope will make them more useful than Bitcoin in certain use cases.

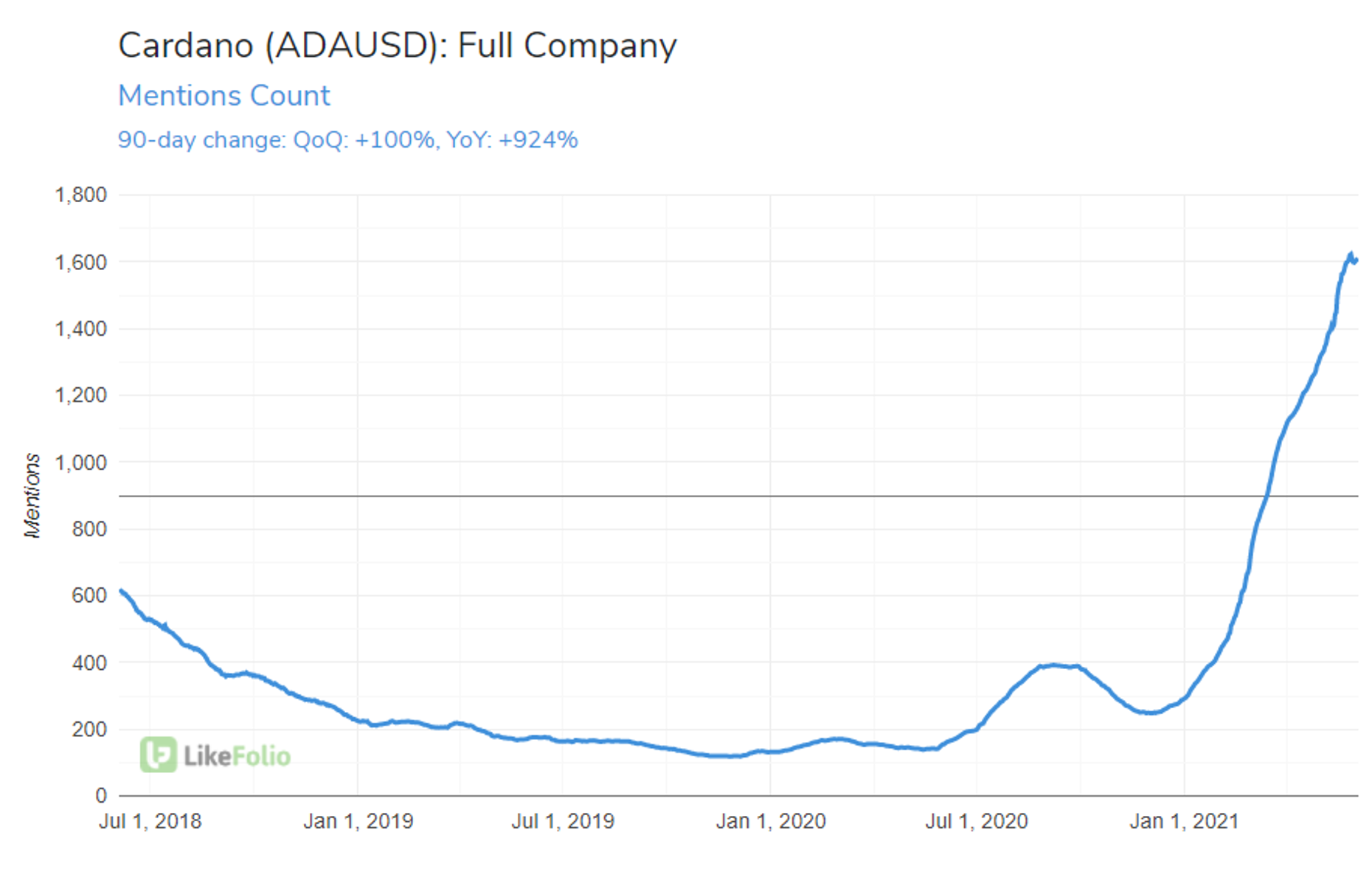

For example, Cardano was developed as a “Proof of Stake” cryptocurrency, rather than Bitcoin’s “Proof of Work” approach. Many believe this is a more efficient means of proving ownership and transfer.

This differentiation is paying off.

While Bitcoin interest has moved higher by 147% since last year, Cardano (ADA) has seen investor interest skyrocket by 924% in the past year:

Of course, no one knows exactly what the future holds for precious metals, cryptocurrencies, or even inflation itself.

But by keeping our eye on consumer interest levels over time, we can develop a strong advantage over the rest of the market in knowing where the crowd might be headed next.

Andy Swan,

Founder, LikeFolio