Netflix is Experiencing a Covid Hangover

When Netflix reported soft subscriber metrics, the market reacted as if the show was over. In reality, the streaming TV king sits comfortably atop its throne despite competitive pressures.

Q4 subscriber additions were down -3% YoY. Guidance for 2.5 million additional subscribers in the current quarter implies a sharper slowdown. But fear not!

In the words of Netflix co-founder Reed Hastings, “It’s probably a bit of just overall Covid overhang…”

Nevertheless, the stock got slammed so bad, you’d think there is more to the story. Is there? Are consumers any less enamored with Netflix?

Nope.

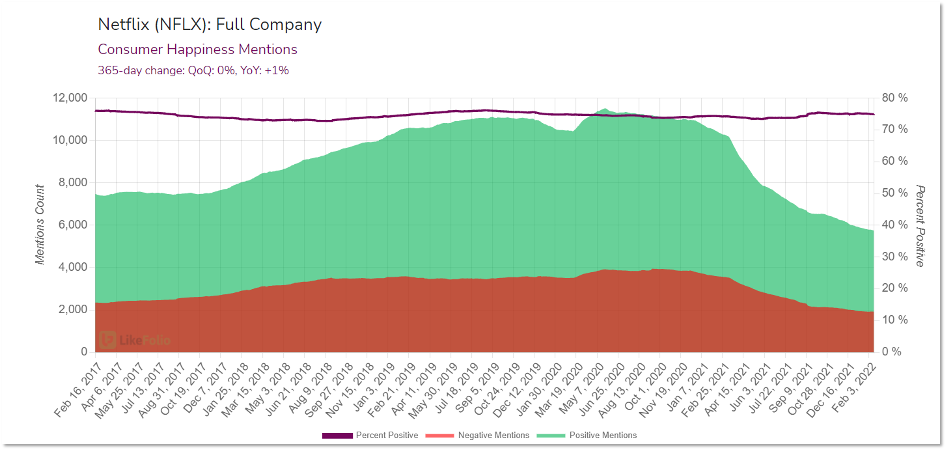

Look no further than LikeFolio’s latest Consumer Happiness data.

Over the past decade, Netflix’s Consumer Happiness reading has been remarkably consistent, bouncing within the 70% to 80% range.

The current reading is 75%. Smack in the middle of the historic range.

This gives credence to management’s assertion that it is witnessing a lingering pull-forward effect from the hyper-demand of 2020.

And as it astutely noted, the shortfall of 220,000 new subscribers in Q4 represents 0.1% of its global customer base of 220 million subscribers.

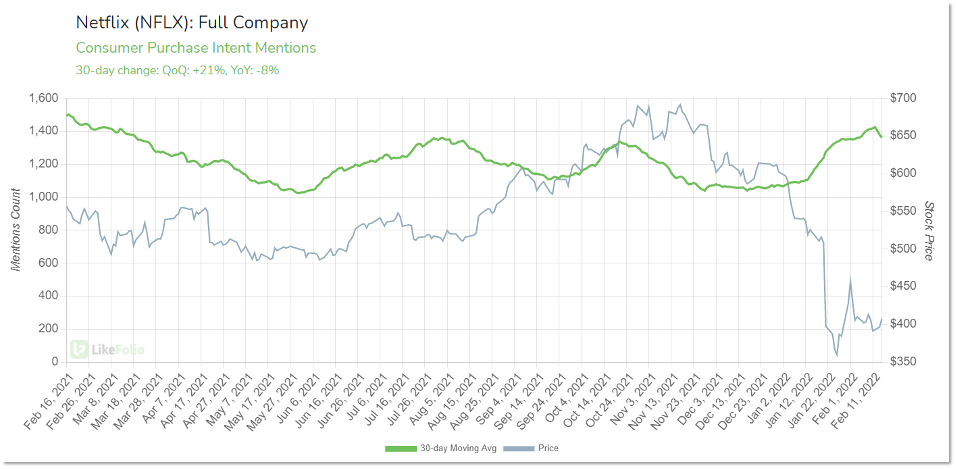

Simply put, we aren’t seeing any indication that consumers plan to scale back on Netflix. In fact, it’s the opposite.

LikeFolio’s Consumer Purchase Intent Mentions (using and downloading Netflix) have trended higher since Q4 ended: +21% QoQ.

Ok, that’s comforting. But what about that weak outlook for Q1?

Are competitors gaining ground?

Streaming Competition Is Intensifying

Super Bowl ad season confirmed that the streaming wars are heating up.

- Amazon reminded us that Thursday Night Football is coming to Prime Video… and gave a sneak peak of “Lord of the Rings: The Rings of Power”

- Disney+ told us that it has “GOATs” old and new

- HBO Max flashed a trailer for its new show about the L.A. Lakers

- AMC+ jumped into the fray with a spot about its new streaming service

And then there was Netflix, which teased movies still to come in 2022, including “The Adam Project,” featuring a star-packed cast. Hello, Ryan Reynolds.

It’s too early to tell if these campaigns are having an impact on subscriptions… but it’s never too early to check in on LikeFolio’s Media Consumption Trends.

Social media mentions of “staying at home” are up +26% QoQ. We wondered if this was a winter weather effect, but looking at how this trended lower in February 2021, this doesn’t seem to be the case.

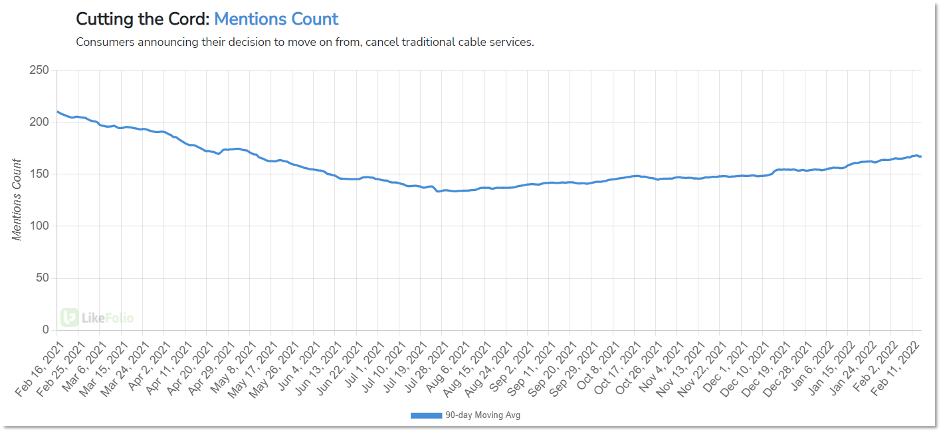

This combined with the fact that “cutting the cord” mentions are up +17% QoQ tells us that the streaming TV market is alive and well.

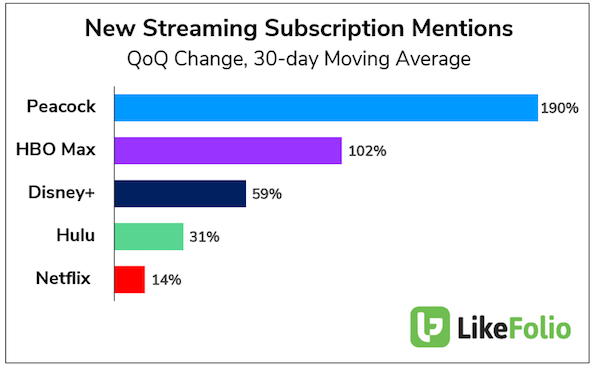

Now, what about new subscription trends?

Chatter around new Peacock, HBO Max, Disney+, and Hulu subscriptions are all up QoQ. (Note that Peacock received an ultra-boost due to Super Bowl streaming placement behind its subscription paywall. This could be a temporary bump.)

Netflix, on the other hand, is trailing peers. How could that be?

Setting aside the fact that Netflix is the largest player in the streaming game, as some Wall Street analysts have mentioned, Netflix’s Q1 release schedule is back-end loaded. For instance:

- “Against the Ice” (March 2)

- “Pieces of Her” (March 4)

- “Human Resources” (March 18)

- “Bridgerton,” Season 2 (March 25)

This leads us to believe that many would-be Netflix subscribers have pressed the pause button in anticipation of new rollouts over the next couple months, especially the hit series “Bridgerton.”

Still convinced that Netflix is losing its mojo?

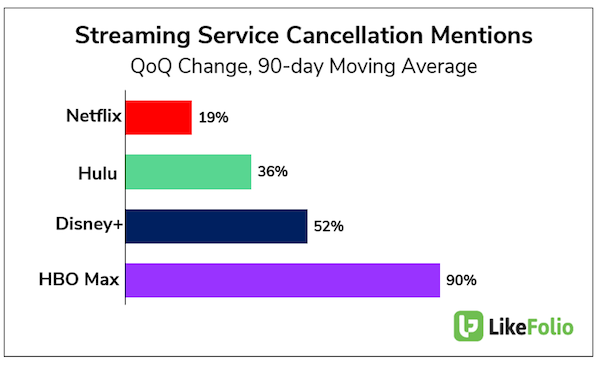

Then check out what people are saying about streaming service cancellations.

As you can see in the above chart, mentions of cancelling streaming services are up across the board as many consumers cull subscriptions at the start of the new year.

But Netflix is recording the most significant staying power. In fact, Netflix cancellation mentions have actually dropped -30% YoY!

This adds fuel to the notion that Netflix’s loyal customer base isn’t budging.

So if competitors are adding subscribers while Netflix stands relatively idle, what does this suggest?

Netflix has a Premium Perception

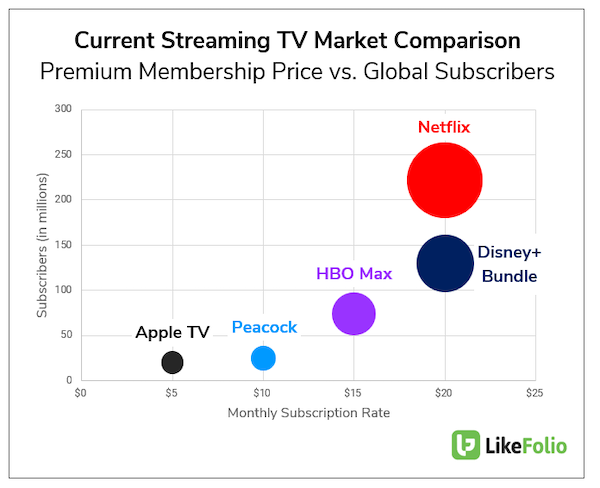

For starters, it probably means that consumers are still comfortable signing up for multiple streaming services.

Heck, if we’re accustomed to paying more at the pumps and grocery stores, why not fork over a few more bucks for another entertainment subscription?

This seems more rational when you’ve already paid more for Netflix and can tack on new services at lower monthly rates.

Last month, Netflix announced price hikes for U.S. and Canadian consumers. Basic, the most popular plan, is up to $10/month; Standard is $15.49/month; and Premium is $20/month. Compare this to:

- Disney+/Hulu/ESPN+ bundle: $20/month

- HBO Max: $15/month

- Peacock (ad-free): $10/month

- Apple TV: $4.99/month

- Amazon Prime Video: included with Prime membership

Competitors’ cheaper offerings make them attractive as add-on services rather than substitutes.

Including Hulu and ESPN+ subscribers, Disney’s bundled subscription base of 196 million trails that of Netflix.

And of course, with exposure to the cyclical theme park business, Disney is not the streaming pure-play that Netflix is.

Most consumers aren’t willing to part with Netflix because they recognize that the hits will keep coming. Blockbuster originals that cater to local (e.g., “Lupin” in France) and broad audiences (“Squid Game”) are presumably forthcoming.

Bottom line: People don’t have a problem paying more for Netflix, because it’s considered a premium product. As such, we expect Netflix will be able to continue to raise prices as long as consumers believe they are getting value.

Summary: Netflix Will Recover

The Rams are Super Bowl champs… and Netflix is still the streaming champ.

Consumers are no less happy with Netflix than they have been from the start.

Near-term subscriber growth weakness will likely evolve into long-term success as the streaming leader continues to capitalize on its “first mover” advantage and expand globally.

As management noted, customer retention and engagement among existing subscribers remains solid, and churn trends are benign.

We’ve seen this movie before. Disappointing subscriber metrics drag NFLX lower, only to see it recover to new highs. A lot of ground needs to be made up this time around, but based on the latest recent LikeFolio data, we see the stock trending higher over time.

Netflix may have lost the battle in Q4, but it is still a force to be reckoned with in Hollywood… and it is still winning the war.

Megan Brantley

Head of Research, LikeFolio